Top Ten Smart Money Moves – August 5, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 5, 2016 Data)

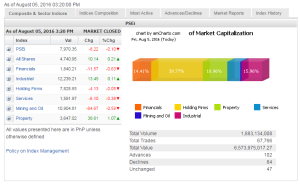

Total Traded Value – PhP 6.574 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 102 Advances vs. 84 Declines = 1.21:1 Neutral

Total Foreign Buying – PhP 2.954 Billion

Total Foreign Selling – (PhP 3.059) Billion

Net Foreign Buying (Selling) (PhP 0.105) Billion – 1st day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

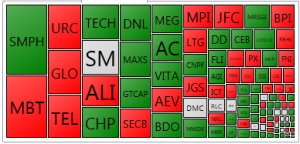

PSE HEAT MAP

Screenshot courtesy of PSEGET

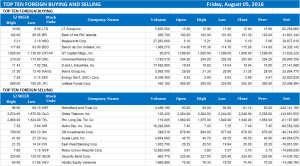

Top Ten Foreign Buying and Selling

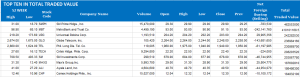

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks end flat as investors sit on sidelines

Posted on August 06, 2016

THE Philippine stock market closed the week flat as investors awaited the latest US jobs report due out Friday night.

The Philippine Stock Exchange index (PSEi) shed 8.22 points or 0.10% to close the week at 7,970.35. This was 7.24 points up from a week ago’s close of 7,963.11.

The all-shares index rose by 10.14 points or 0.21% to 4,740.95. Gainers outnumbered losers at 102 to 84, while 47 shares finished unchanged.

“Investors are still waiting for the US jobs data, so they are on the sidelines,”Alexander Adrian O. Tiu, research analyst for AB Capital Securities, Inc. said in a phone interview.

The US government overnight is scheduled to release its latest monthly jobs data, with the market factoring in job gains of 180,000, indicating that the American labor market is on a steady growth path.

Investors are “tentative ahead of all important US jobs report…[That] could give a clue to [US] Fed[eral Reserve] rate monetary policy moving forward,” Nisha S. Alicer, chief equity strategist for DA Market Securities, Inc., said in a text message to BusinessWorld.

The US central bank is largely seen to stay its course of tempering further rate increases, which has sent portfolio flows to emerging markets like the Philippines, which enjoyed net inflows of $1.5 billion as of the third quarter of July, up from less than half a billion in the same period last year.

‘GHOST MONTH’

“We’ve also entered the ghost month after a strong rally since June, [so the] market is susceptible to profit taking,” Mr. Alicer said, referring to a period of minimal trading that started on Wednesday and is expected to last until the end of August.

An indication of this is the drop in trading value to P6.57 billion, nearly 8% lower than the previous day’s P7.14 billion.

Ms. Alicer set the PSEi’s initial support at 7,800, a break in which would mean a drop to 7,600, adding that resistance would be around 8,000 or 8,100.

Alexander Adrian O. Tiu, senior equity analyst at AB Capital Securities, Inc., described the index as slightly “toppish,” which could signal its trek downwards.

Mining still incurred the most losses at 64.67 points, or 0.59% to close the week at 10,904.81. This was followed by financials which lost 11.57 points or 0.63% to 1,840.21, and services which dropped 6.10 points or 0.38% to 1,591.97. The holding firms sub-index was flattish, ending 4.13 points or 0.05% lower at 7,828.93.

“Mining suffered the heaviest because of the current stance of the President and the DENR,” Mr. Tiu said, referring to the anti-mining statements by President Rodrigo R. Duterte and his Environment Secretary Gina Lopez.

Mr. Tiu said financials was brought down by Metropolitan Bank and Trust Co., which declined by almost 2% following weak second-quarter earnings.

In services, Philippine Long Distance Telephone Co. (PLDT), whose shares plunged mid-week and weighed the market down, slipped by 0.51% to close at P1,940.

FEW BRIGHT SPOTS

Ms. Alicer said there were a few bright spots: “The market will be selective depending on earnings results coming out for [first half of 2016].”

Property gained the most by 38.61 points or 1.07% to 3,647.02, while industry ended slightly higher by 13.45 points or 0.11% to 12,239.21.

“The companies who have already shown good performance they are the ones benefiting right now,” said Anton G. Alfonso, equity research analyst for RCBC Securities, Inc, in a phone interview.

He cited SM Prime Holdings, Inc. (SMPH) and Megaworld Corporation (MEG) as the two companies that drove the gains in the properties sector.

It was the fifth most actively traded stock yesterday, next only to SM Prime Holdings, Inc., Metropolitan Bank & Trust Co., Universal Robina Corp. and Globe Telecom. — Victor V. Saulon and Lucia Edna P. de Guzman

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-end-flat-as-investors-sit-on-sidelines&id=131511

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion