Top Ten Smart Money Moves – August 8, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 8, 2016 Data)

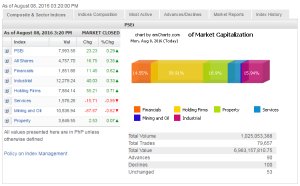

Total Traded Value – PhP 6.983 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 100 Declines vs. 90 Advances = 1.11:1 Neutral

Total Foreign Buying – PhP 3.200 Billion

Total Foreign Selling – (PhP 3.459) Billion

Net Foreign Buying (Selling) (PhP 0.259) Billion – 2nd day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

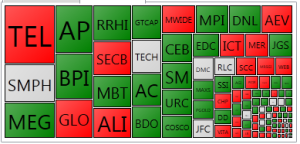

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

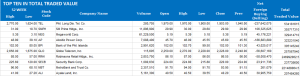

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PHL shares inch up ahead of first-half earnings

Posted on August 09, 2016

THE PHILIPPINE Stock Exchange index (PSEi) on Monday moved marginally higher ahead of more first-half earnings data and as Asian equities reacted positively to the US jobs report.

The PSEi went up by 23.23 points or 0.29% to close at 7,993.58 yesterday. The all-shares index also gained 16.75 points or 0.35% to settle at 4,757.70.

July non-farm payrolls rose by 255,000 and the June increase was revised upward to 292,000, the US Labor Department said last Friday.

Four of the six sectoral indices managed to close higher led by holding firms, which climbed by 55.21 points or 0.70% to 7,884.14. Financials gained 11.45 points or 0.62% to 1,851.66. Industrials went up 40.03 points or 0.32% to 12,279.24. Property inched up by 2.53 points or 0.06% to 3,649.55.

In contrast, services retreated by 15.71 points or 0.98% to 1,576.26 while mining and oil lost 67.87 points or 0.62% to 10,836.94.

PLDT, Inc. was the top traded stock, followed by SM Prime Holdings, Inc., Megaworld Corp., Aboitiz Power Corp. and Bank of the Philippine Islands.

The top gainers were Discovery World Corp., Philippine H20 Ventures Corp. and Euro-Med Laboratories Phils., Inc.

The companies that recorded the biggest losses were PhilWeb Corp., Leisure and Resorts World Corp. warrants and Oriental Petroleum and Minerals Corp. “A.”

PhilWeb plunged 43.06%, resuming its slide from last week after President Rodrigo R. Duterte last Wednesday vowed to “destroy the oligarchs that are embedded in government” and branded the company’s Chairman and Chief Executive Officer Roberto V. Ongpin as an oligarch. Mr. Ongpin quit his post the next day.

“We feel that President Duterte may have been misinformed,” PhilWeb President Dennis O. Valdes told the exchange on Monday.

Foreign investors yesterday sold P3.46 billion worth of shares while buying almost P3.2 billion, resulting in a net selling of P259 million, more than Friday’s net sales valued at some P105.27 million.

Total value of traded stocks reached P6.98 billion, up from P6.57 billion last Friday, as 1.03 billion shares changed hands.

Losers outnumbered gainers at 100 to 90, while 53 shares closed unchanged.

Miko A. Sayo, who trades for Angping & Associates Securities Inc., said he expects the index’s sideways movement to continue this week.

He also sees a “strong US market, but foreign funds seem to be done buying” in the Philippine market.

Southeast Asian stocks rose on Monday after stronger-than-expected US jobs data raised expectations of a rate increase by the Federal Reserve, with Thailand hitting a 16-month high after Thais voted to accept a new military-backed constitution.

The “yes” vote in the Thai referendum is expected to pave the way for an election next year and reduce political uncertainty in Southeast Asia’s second-largest economy. — VVS with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=phl-shares-inch-up-ahead-of-first-half-earnings&id=131597

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion