Top Ten Smart Money Moves – December 10, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

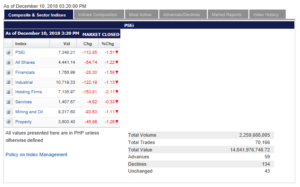

Advances Declines – (Ideal is 2:1) 134 Declines vs. 59 Advances = 2.27:1 Bearish

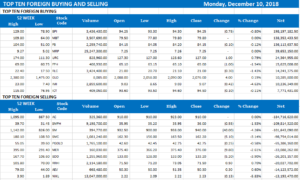

Total Foreign Buying PhP 11.950 Billion

Total Foreign Selling – (PhP 7.988) Billion

Net Foreign Buying (Selling) – PhP 3.962 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

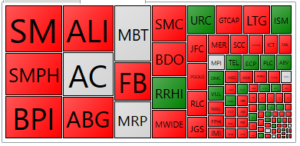

PSE HEAT MAP

Screenshot courtesy of PSEGET

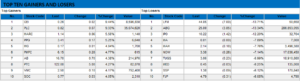

Top Ten Foreign Buying and Selling

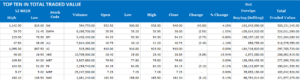

Top Ten in Total Traded Value

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Local shares join global rout on trade worries

December 10, 2018 | 9:00 pm

THE LOCAL BOURSE took a dive on Monday as trade tension between the United States and China pummeled market sentiment across the globe.

The benchmark Philippine Stock Exchange index (PSEi) fell 1.51% or 112.85 points to close at 7,348.21 yesterday, marking its fourth day of losses, while the broader all-shares index dropped 1.21% or 54.74 points to 4,441.14.

“Equities markets were down all Asia including here in the PSE as worries that a rise in tensions between Washington and Beijing could ruin the chances of a trade deal,” Eagle Equities, Inc. Research Head Christopher John Mangun said in an e-mail on Monday.

Canada’s arrest of Chinese tech giant Huawei’s chief financial officer last week continued to worry investors, despite a 90-day truce promised by US President Donald J. Trump and Chinese President Xi Jinping last month.

The PSEi took cues from Wall Street’s negative performance last Friday, when the Dow Jones Industrial Average lost 2.24% or 558.72 points to 24,388.95; the S&P 500 index retreated 2.33% or 62.87 points to 2,633.08; and the Nasdaq Composite index plunged 3.05% or 219.01 points to 6,969.25.

Most Asian indices also fell, with Japan’s Nikkei 225 closing 2.12% lower, the Shanghai Composite index shedding 0.82%, while MSCI’s broadest index of Asia-Pacific shares ex-Japan losing 1.4%.

Mr. Mangun, however, noted that from a technical standpoint, the PSEi’s decline was a “healthy pullback” given its rally in the last three weeks.

All sectoral indices moved to negative territory, led by holding firms which incurred a 2.11% loss or 153.81 points to 7,135.97. Financials shed 1.58% or 28.30 points to 1,766.99; property slumped 1.25% or 45.86 points to 3,600.40; industrials tumbled 1.12% or 122.19 points to 10,719.33; mining and oil slipped 1.11% or 93.63 points to 8,317.60; while services declined 0.32% or 4.62 points to 1,407.67.

Some 2.26 billion shares worth P14.84 billion switched hands, compared to last Fiday’s 2.32 billion issues worth P6.29 billion. Without block transaction of Melco Resorts and Entertainment (Philippines) Corp., turnover would have been P5.1 billion. The company’s majority shareholder concluded its voluntary tender offer last week, with the shares tendered crossed from the PSE yesterday.

Foreign investors turned buyers, with net purchases at P3.96 billion, compared to Friday’s P261.78 million in net sales. The large figure, however, could also be attributed to Melco’s block transaction.

Stocks that declined were more than double those that advanced, 134 to 59, while 43 others ended flat.

“Looks like we’ll be short of catalysts for the remainder of the year, with the only possible exception being year-end window dressing,” Papa Securities Corp. Head of Online Trading Arbee B. Lu said in a separate e-mail.

“Considering how US markets are heavily in the red though, we aren’t expecting a significant boost from funds abroad.” — Arra B. Francia

Source: https://www.bworldonline.com/local-shares-join-global-rout-on-trade-worries/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.