Top Ten Smart Money Moves – December 5, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on December 5, 2016 Data)

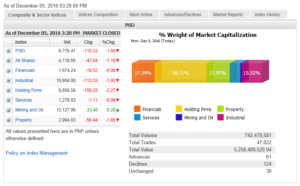

Total Traded Value – PhP 5.258 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 124 Declines vs. 61 Advances = 2.03:1 Bearish

Total Foreign Buying – PhP 3.102 Billion

Total Foreign Selling – (PhP 3.403 Billion)

Net Foreign Buying (Selling) – (PhP 0.303) Billion – 2nd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

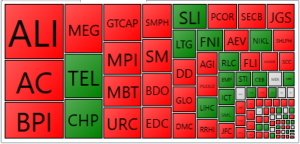

PSE HEAT MAP

Screenshot courtesy of PSEGET

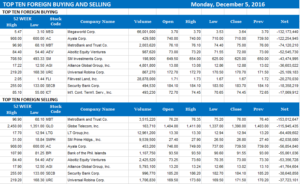

Top Ten Foreign Buying and Selling

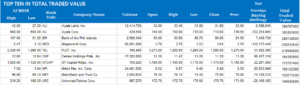

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index drops on Robredo, Renzi resignations

Posted on December 06, 2016

STOCKS slumped at the start of the week following Vice-President Maria Leonor G. Robredo’s resignation from her post in the Cabinet and the result of the Italian referendum that caused Prime Minister Matteo Renzi to also step down from his post.

The bellwether Philippine Stock Exchange index dropped 1.60% or 110.33 points to 6,776.41 points.

The broader all-shares index also slid 1.14% or 47.84 points to close Monday’s trading at 4,118.65 points.

“The PSEi just tracked the broader Asian market following the result of the Italian referendum which failed. So it establishes nationalist movements like ‘Brexit’ and [US President Donald J.] Trump’s election,” said Ralph Christian G. Bodollo, equity research analyst at RCBC Securities, Inc., in a phone interview on Monday, adding that local stocks saw “much deeper” losses compared with its Asian counterparts.

Mr. Bodollo added that Ms. Robredo’s resignation from her post in President Rodrigo R. Duterte’s Cabinet, with the question of her keeping the vice-presidency causing risk aversion.

Ms. Robredo announced on Sunday her resignation as chairperson of the Housing and Urban Development Coordinating Council, a post she occupied for barely five months, following instructions from Mr. Duterte ordering her to stop attending Cabinet meetings.

Victor F. Felix, equity analyst at AB Capital Securities, Inc., said Ms. Robredo’s resignation “just adds to the level of political risk that the country has.”

“In terms of foreign investors, maybe they feel it’s getting riskier to invest in the Philippines,” Mr. Felix said in a phone interview, adding that the local market may hover at 6,700 to 6,800 levels for the rest of the week.

Foreigners continued to dump shares on Monday, with net selling increasing to P300.61 million from Friday’s P223.34 million.

The holding firms sub-index slumped 159.25 points or 2.27% to 6,856.58; property declined 56.44 points or 1.85% to 2,994.03; industrial went down 112.33 points or 1.02% to 10,904; financials gave up 16.52 points or 0.97% to 1,674.24; and services edged down 1.11 point or 0.09% to 1,279.03.

Only the mining and oil counter ended in the green, rising 33.40 points or 0.28% to close the session at 12,127.96.

Decliners outnumbered advancers, 124 to 61, while 39 issues were unchanged.

Value turnover declined to P5.26 billion yesterday from Friday’s P6.85 billion after 742.48 million shares changed hands.

RCBC’s Mr. Bodollo said the main index may extend its slump today as investors remain cautious ahead of the US Federal Reserve’s policy meeting on Dec. 13-14.

“There will be a possibility of a further slide because we closed at the low. There might be momentum [today] and the Fed meeting is next week, so we expect some investors to stay on the sidelines before that,” Mr. Bodollo said. — Janina C. Lim

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-drops-on-robredo-renzi-resignations&id=137332

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion