Top Ten Smart Money Moves – December 9, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on December 9, 2016 Data)

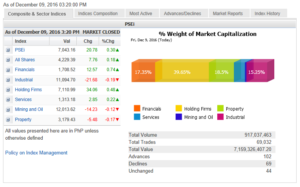

Total Traded Value – PhP 7.159 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 102 Advances vs. 69 Declines = 1.48:1 Neutral

Total Foreign Buying – PhP 3.445 Billion

Total Foreign Selling – (PhP 4.387 Billion)

Net Foreign Buying (Selling) – (PhP 0.942) Billion – first day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

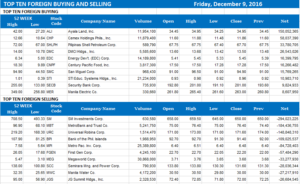

Top Ten Foreign Buying and Selling

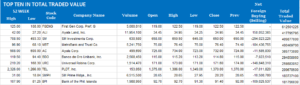

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index likely to stay above 7,000 ahead of Fed

Posted on December 12, 2016

THE MAIN INDEX is seen to continue hovering within the 7,000 level this week, although investors will still trade more cautiously ahead of the Federal Reserve meeting, with markets almost certain of an interest rate increase as the US economy continues to improve.

Last week, the bellwether Philippine Stock Exchange index returned to the 7,000 level, finishing the week at 7,043 points, rising 2.27% or 156.42 points from its Dec. 2 close. Net foreign outflow slowed to P141 million from the prior week’s P431 million, with losers dominating gainers, at 91 and 88, respectively.

“Investors will be cautious ahead of the Fed meeting. All eyes will be on the US [this] week,” Unicapital Securities, Inc. Research Head Lexter A. Azurin said in a text message over the weekend.

The US central bank holds a policy meeting on Dec. 13-14, during which it is expected to hike interest rates for the first time in a year.

“With roughly 97% chance of a Fed rate hike…, investors seem to have gained confidence with the Fed’s intention to hike rates sooner rather than later. This would help investors and fund managers realign portfolios with the new level of cost of money and prepare an equity strategy before 2017 starts,” online brokerage 2TradeAsia.com said in a statement over the weekend.

While monetary tightening indicates stronger economic gains in the US, local authorities may be study the possibility of pushing for similar moves, which may affect sentiment, the brokerage said.

“For now, fund managers are unlikely to go underweight in their emerging market positions, on the back of high-growth opportunities in the region,” 2TradeAsia.com said.

“Despite uncertainties in the local front leading to market volatility, investors might find some easing on the demand side over the latest consumer expectations data released by the central bank.”

The fourth-quarter Consumer Expectations Survey saw a 9.2% net confidence index among Filipinos, establishing a new high from the 2.5% recorded the preceding three months just as President Rodrigo R. Duterte took office, the Bangko Sentral ng Pilipinas reported last Friday.

Meanwhile, the online brokerage added that local equities could still finish the year on a positive note with some 3% increase from the end-2015 close of 6,952.08 despite political uncertainty due to the change in administrations both locally and in the US.

“[C]onsumers see no reason to be negative about the last quarter of the year amid expectations of higher remittances and disposable income,” 2TradeAsia.com said.

The brokerage noted that this week, players will anticipate the listing of pizza chain Shakey’s Pizza Asia Ventures, Inc. scheduled on Dec. 15 in the absence of other leads.

The main index is expected to remain above the 7,000 level with resistance pegged at 7,150, it said, regardless of any disruption that might stem from political headlines. — J.C. Lim

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-likely-to-stay-above-7000-ahead-of-fed&id=137592

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion