Top Ten Smart Money Moves – February 10, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on February 10, 2017 Data)

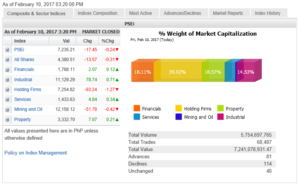

Total Traded Value – PhP 7.241 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 114 Declines vs. 81 Advances = 1.41:1 Neutral

Total Foreign Buying – PhP 4.196 Billion

Total Foreign Selling – (PhP 4.363 Billion)

Net Foreign Buying (Selling) – (PhP 0.167 Billion) – 5th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

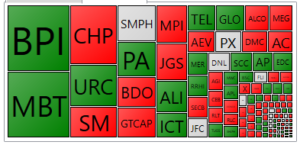

PSE HEAT MAP

Screenshot courtesy of PSEGET

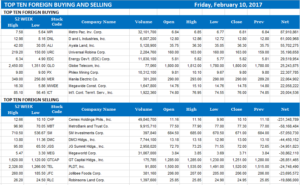

Top Ten Foreign Buying and Selling

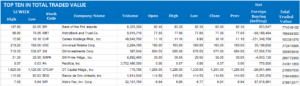

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Shares drop on MSCi rebalancing, mining uncertainty

Posted on February 11, 2017

THE Philippine Stock Exchange index (PSEi) on Friday extended its losses on Friday, closing down 0.24% or 17.45 points at 7,235.21 as investors tracking a key emerging-markets index reconfigured their portfolios, traders said.

“Markets dropped this time despite most regional markets closing in the green as local selling pressure was due to the release of the recent MSCi rebalancing as only one PSEi constituent saw a relevant increase,” said Luis A. Limlingan, business development head at Regina Capital Development Corp.

“Aside from this, the market continued to grapple with the latest input of the [Bangko Sentral ng Pilipinas] regarding the next rate hike,” he added.

Mr. Limlingan also cited the continuing debate among stakeholders in the mining industry, which has been reeling after the Environment department ordered the closure of several mining companies, some of which are listed on the exchange.

Hans B. Sicat, president and chief executive officer of Philippine Stock Exchange, has added his voice to the plea from mining companies for their side to be heard by the relevant government agencies.

He said the situation has become almost a trial by publicity since the affected companies themselves do not know what is happening.

“They have not received official orders [for closure or suspension] from the DENR (Department of Environment and Natural Resources),” he said in a briefing hosted by the Philippine Chamber of Commerce and Industry.

“The companies could not answer our direct question as to whether they received the order or whether they thought the order was a lawful one and not undue. We don’t take this lightly,” he added.

Mining and oil stocks retreated by 0.42% or 51.78 points to 12.158.12 even after the Office of the President announced that miners would be given a chance to review the findings of the DENR that led to the closure orders.

Apart from mining and oil, the only other index that declined was holding firms, which slipped by 1.27% or 93.24 points to 7,254.82.

Value improved to P7.24 billion from P6.69 billion the previous day. Decliners once again outnumbered advancers 114 to 81, while 40 issues finished unchanged. Foreigners sold more shares than they bought, resulting in net selling of P166.87 million, from P619.99 million previously.

Outside the country, Mr. Limlingan said US stock exchanges all rallied to record highs on Thursday, “but the number of stocks hitting 52-week highs has dropped sharply, which could suggest that participation in the rally may be waning.” — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=shares-drop-on-msci-rebalancing-mining-uncertainty&id=140472

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion