Top Ten Smart Money Moves – February 27, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on February 27, 2017 Data)

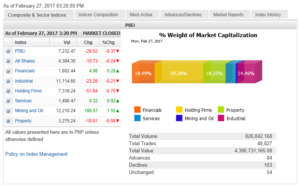

Total Traded Value – PhP 4.391 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 103 Declines vs. 84 Advances = 1.23:1 Neutral

Total Foreign Buying – PhP 1.971 Billion

Total Foreign Selling – (PhP 2.103 Billion)

Net Foreign Buying (Selling) – (PhP 0.132) Billion – first day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

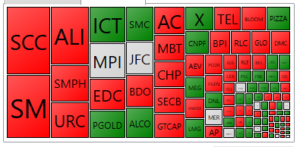

PSE HEAT MAP

Screenshot courtesy of PSEGET

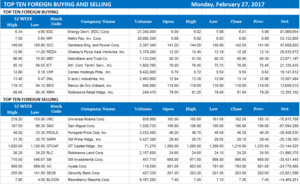

Top Ten Foreign Buying and Selling

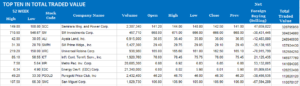

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks down as overseas concerns weigh on mart

Posted on February 28, 2017

LOCAL STOCKS resumed their trek downwards on Monday as the Philippine Stock Exchange index (PSEi) declined by 26.52 points, or 0.36%, to close at 7,232.47, largely as a result of developments outside the country, analysts said.

“Philippine markets closed in the red as the US indices were artificially pushed up while Asian counterparts mostly traded in negative territory,” said Luis A. Limlingan, business development head at Regina Capital Development Corp.

He said a large market-on-close order came and “pushed the Dow to its 11th straight winning streak, longest since 1987.”

“While the major averages continue to post record all-time highs with alarming regularity the performance over much of the week pointed to confusion about what exactly the ‘Trump trade’ is, or whether that narrative remains valid? With that in mind Trump’s first major presidential address to a joint session of Congress on Tuesday will take on even greater significance,” Mr. Limlingan said.

The broader all shares index also moved down by 10.73 points, or 0.24%, to finish at 4,384.35.

Sector counters were split, with financials, services, and mining and oil performing positively, while industrials, holding firms and property declining.

Mining and oil stocks gained 186.57 points or 1.55% to close at 12,210.24. The movement of the rest of the indices did not go past 1%.

Value turnover reached P4.39 billion, down from P6.40 billion on Friday, with just 826.84 million shares changing hands on Monday.

After the previous session’s net foreign buying, foreigners were back to unloading more stocks than they bought, resulting in a net selling of P131.70 million worth of shares.

Semirara Mining and Power Corp. (SMPC) was the session’s most active stock, followed by SM Investments Corp., Ayala Land, Inc., SM Prime Holdings, Inc., and Universal Robina Corp.

Last Friday, SMPC said higher coal and power sales fueled net income to reach a record-high P12 billion in 2016, a jump of 42% from P8.47 billion in the previous year, the Consunji-led company said.

Southeast Asian stock markets moved sideways on Monday, in line with Asian peers ahead of US President Donald J. Trump’s speech to a joint session of Congress on Tuesday night, where he is expected to unveil some elements of his plans to cut taxes.

Mr. Trump would use the speech to disclose some elements of his sweeping plans to cut taxes for the middle class, simplify the tax system and make American companies more globally competitive with lower rates and changes to encourage manufacturing, Treasury Secretary Steven Mnuchin said in an interview broadcast on Sunday.

Investors will also be looking for details on how Mr. Trump would like to overhaul former President Barack Obama’s signature health care law.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-down-as-overseas-concerns-weigh-on-mart&id=141342

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion