Top Ten Smart Money Moves – Jan. 14, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 14, 2016 Data)

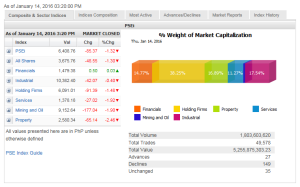

Total Traded Value – PhP 5.256 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 149 Declines vs. 27 Advances = 5.52:1 Bearish

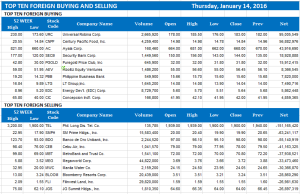

Total Foreign Buying – PhP 2.913 Billion

Total Foreign Selling – (Php 3.402) Billion

Net Foreign Buying (Selling) – (Php 0.489) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

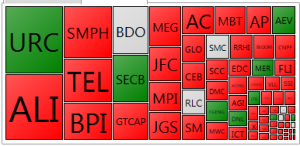

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

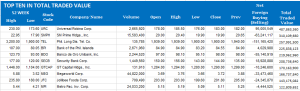

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 14, 2016 08:11:00 PM

By Krista A. M. Montealegre, Senior Reporter

Bourse resumes drop as global growth fears persist

PHILIPPINE EQUITIES resumed their decline yesterday, ending a two-day “technical rebound,” as Wall Street took another beating overnight on lingering concerns about global economic growth.

The bellwether Philippine Stock Exchange index (PSEi) declined 85.37 points or 1.31% to close at 6,408.76, while the broader all-shares index similarly gave up 48.55 points or 1.30% to finish at 3,675.76.

“The market fell anew following the drop in Wall Street and Asian stocks. Thus, what we saw in the past few days was merely a technical rebound,” BDO Unibank, Inc. Chief Market Strategist Jonathan L. Ravelas said in a mobile phone message.

“The recovery in China was sort of a relief rally because exports were better than expected, but the fundamental issues have not been addressed. The outlook for commodity prices remains poor,” COL Financial Group, Inc. Head of Research April Lynn L. Tan said in a telephone interview.

Prior to Thursday’s decline, the PSEi staged a two-day recovery after a four-day slump that sent the main gauge to its lowest level in nearly two years. The benchmark index remains in a bear market, down 21.15% from its peak of 8,127.48 logged on April 10 last year.

Asian markets took their cue from Wall Street’s steep losses on Wednesday night, dragged by fears of a deepening slowdown in China and emerging economies as well as volatility in financial markets, oil and other commodities.

The Dow Jones industrial average plunged 364.81 points or 2.21% to 16,151.41. The S&P 500 plummeted 48.40 points or 2.50% to 1,890.28 and the Nasdaq composite lost 159.85 points or 3.41% to 4,526.07.

Brent crude oil slipped below $30 a barrel for the first time in a decade.

Five of the six sectoral indices ended in negative territory, with financials being the lone counter ending with gains, rising by half a point or 0.03% to 1,479.38.

In contrast, property sank 65.14 points or 2.46% to 2,580.34, services went down 27.02 points or 1.92% to 1,378.18, mining and oil tumbled 177.04 points or 1.89% to 9,152.64, holding firms slumped 91.39 points or 1.47% to 6,091.01, and industrial slid 42.07 points or 0.40% to 10,382.40.

Value turnover dipped to P5.26 billion after 1.80 billion shares were traded, just a third of Wednesday’s P6.22 billion.

Losers dominated gainers, 149 to 27, while 35 issues were unchanged.

Foreign investors dumped local equities, making yesterday log net sales of P489.47 million — a reversal of the net purchases of P250.06 million in the prior session.

“Technically, the downward momentum is still there. We advise investors to be cautious,” COL Financial’s Ms. Tan said, pegging the local barometer’s support at its previous low of 6,280 and resistance at 6,600.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=bourse-resumes-drop-as-global-growth-fears-persist&id=121483

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.