Top Ten Smart Money Moves – January 31, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on January 31, 2017 Data)

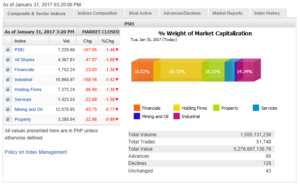

Total Traded Value – PhP 5.277 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 126 Declines vs. 66 Advances = 1.91:1 Neutral

Total Foreign Buying – PhP 2.923 Billion

Total Foreign Selling – (PhP 3.075 Billion)

Net Foreign Buying (Selling) – (PhP 0.152) Billion – 1st day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

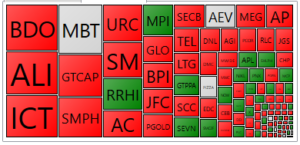

PSE HEAT MAP

Screenshot courtesy of PSEGET

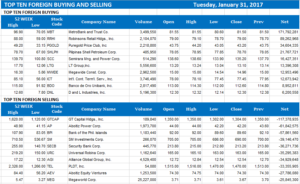

Top Ten Foreign Buying and Selling

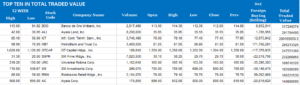

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi sinks to 7,200 level as Trump worries marts

Posted on February 01, 2017

LOCAL STOCKS plunged amid a global sell-off triggered by uncertainties arising from the trade and immigration policies of US President Donald J. Trump.

The bloodbath dragged the Philippine Stock Exchange index (PSEi) back to the 7,200 level on Tuesday. It retreated 107.05 points or 1.45% to 7,229.66 alongside the broader all shares index that descended 47.87 points or 1.08% to 4,367.81.

“The market was down again as investors perceive external risk factors to be higher than the reward at this level as the 7,400 resistance area proves to be stronger than expected,” Frank Gerard J. Barboza, trader at AP Securities, Inc., said in a mobile phone message.

The PSEi dropped to 7,327.90 as soon as trading opened. It made a quick rebound to a high of 7,343.93 within the next minutes before succumbing to the selldown and reaching its intraday low at closing.

The Philippines joined other markets in Southeast Asia, which tripped in reaction to the negative sentiment toward Mr. Trump’s policy on banning immigrants from some Muslim nations, Victor F. Felix, analyst at AB Capital Securities, Inc., noted separately.

“It sent jitters to the market. This opens the possibility of other Asian markets being included in the list [although] I don’t see that any time soon,” Mr. Felix said, noting such a bold action made the market think how far Mr. Trump can go in discouraging American firms from outsourcing jobs.

All counters ended in negative territory, with the services sector losing the most at 22.88 points or 1.58% to settle at 1,423.54. Industrials, meanwhile, dropped by 158.16 points or 1.42% to 10.968.97; holdings firms by 96.90 points or 1.29% to 7,375.24; financials by 23.03 points or 1.29% to 1,752.24; property by 32.98 points or 0.99% to 3,286.04; and mining and oil by 93.75 points or 0.77% to 12,078.85.

Decliners trumped advancers, 126 to 66, while 43 stocks were unchanged.

Investors traded 1.56 billion issues valued at P5.28 billion, a decline from the P4.04-billion value turnover booked on Monday.

Foreigners dumped more shares, posting P152.05 million in net sales and effectively reversing the P234.15-million net purchases seen the previous session.

With the PSEi experiencing difficulty in overcoming resistance at the 7,400 level, AP Securities’ Mr. Barboza noted: “A lot of traders might consider this to be an opportunity to sell because previous highs held and hence the possibility of a top in the short term view.”

The flattish performance of the main index in recent sessions represents a technical pullback from its previous rallies toward the 7,400 mark, AB Capital’s Mr. Felix noted. “What concerns me is the low value turnover in the past few sessions, which was a lot less than P7 billion as some investors don’t want to participate and shift to a risk-off mode.” – Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-sinks-to-7200-level-as-trump-worries-marts&id=139921

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion