Top Ten Smart Money Moves – January 6, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on January 6, 2017 Data)

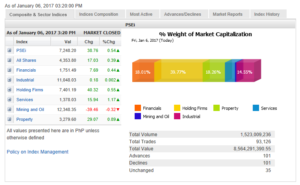

Total Traded Value – PhP 8.564 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 101 Advances vs. 101 Declines = 1:1 Perfectly Neutral

Total Foreign Buying – PhP 4.257 Billion

Total Foreign Selling – (PhP 3.896 Billion)

Net Foreign Buying (Selling) – PhP 0.361 Billion – 6th day of Net Foreign Buying after 12 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

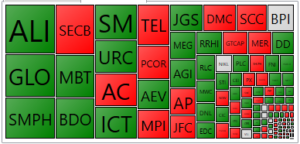

PSE HEAT MAP

Screenshot courtesy of PSEGET

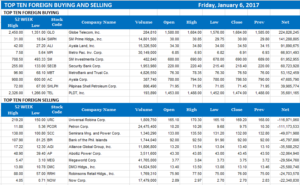

Top Ten Foreign Buying and Selling

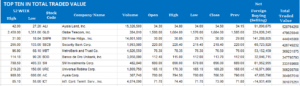

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Wall Street gains boost local shares

Posted on January 07, 2017

STOCKS closed the first trading week of the year with a substantial gain, largely propped up by the movement of the US market.

On Friday, the Philippine Stock Exchange index (PSEi) closed higher by 0.53% or 38.76 points to 7,248.20, while the all-shares index moved up by 0.39% or 17.03 points to 4,353.80.

“That’s more than 400 points in a span of one week,” said Luis A. Limlingan, business development head at Regina Capital Development Corp., of the bellwether’s rise. The PSEi ended 2016 at 6,840.64.

“Net foreign buying is still continuing, but there was some kind of weakness towards the end [of the week],” he said. “We’ve seen foreign buying this whole week.”

Five of the six sectoral indices closed higher on Friday, led by services, which improved by 1.17% or 15.94 points to 1,378.03. All other indices in the green ended the trading session with an increase of no more than 1%, with industrials almost flat as it posted a gain of less than one point.

The mining and oil index, the only decliner, closed 0.31% lower or 39.46 points to 12,348.35.

On Friday, Regina Paz L. Lopez, secretary of the Department of Environment and Natural Resources (DENR), said the agency will be issuing a cease and desist order to a coal-fired power plant owned by a unit of San Miguel Corp. (SMC).

The issuance is amid claims that residents in the area were complaining of illness, and pointing to the plant’s waste as the cause.

On the same day, SMC unit Petron Corp. said that its ash pond is located within its facility and near its office has the required permits to operate.

“It has the necessary regional and local permits from the DENR, is surrounded by dikes, and regularly watered to prevent dispersion,” it said in a statement. “Ash from the pond, certified by DENR as non-hazardous, will be used as raw material for our cement manufacturing plant.”

“Thus reports of ash spill and tons of ash found along the coastline of a distant river, which is almost a kilometer away from our facility, is far from the truth,” Petron said.

Shares in Petron fell 5.34% to P9.75 each, while those of SMC retreated by 0.1% to P97.70 apiece. Petron was among the top 10 losers during session.

Advancers and decliners were even at 101, while 35 stocks closed unchanged.

Value turnover went down to P8.56 billion on Friday from the P10.28 billion seen the previous session, with 1.52 billion shares changing hands.

Net foreign buying went down to P361.43 million from the P727.91 million seen on Thursday. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=wall-street-gains-boost-local-shares&id=138711

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion