Top Ten Smart Money Moves – July 10, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 10, 2017 Data)

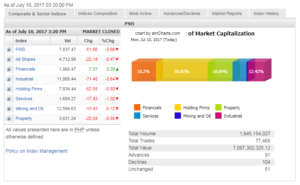

Total Traded Value – PhP 7.087 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 104 Declines vs. 91 Advances = 1.14:1 Neutral

Total Foreign Buying – PhP 3.164 Billion

Total Foreign Selling – (PhP 3.128) Billion

Net Foreign Buying (Selling) – PhP 0.036 Billion – first day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

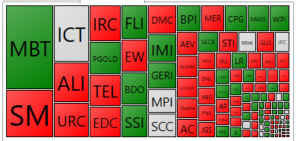

PSE HEAT MAP

Screenshot courtesy of PSEGET

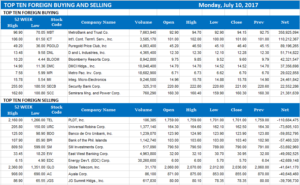

Top Ten Foreign Buying and Selling

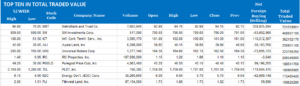

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi slides as US jobs data boost rate hike bets

Posted on July 11, 2017

THE MAIN INDEX started the week in the red as positive US economic data boosted chances of another rate hike by the Federal Reserve within the year.

The bellwether Philippine Stock Exchange index (PSEi) declined 0.65% or 51.86 points to 7,837.47.

The broader all shares index also dropped 0.46% or 22.14 points to close at 4,712.98.

“The market reacted to the US jobs report on Friday. This signals that a rate hike is looming soon, on track to meet the Fed’s target,” AB Capital Securities, Inc. senior research analyst Lexter A. Azurin said in a text message.

US job growth surged more than expected in June and employers increased hours for workers, signs of labor market strength that could keep the Fed on course for a third rate hike this year.

Nonfarm payrolls jumped by 222,000 jobs last month, driven by hefty gains in health care, government, restaurants and professional and business services sectors, the US Labor Department said on Friday.

That was the second biggest payrolls increase this year and beat economists’ expectations for a 179,000 rise. The economy also created 47,000 more jobs in April and May than previously reported. While the unemployment rate rose to 4.4% from a 16-year low of 4.3% in May, that was because more people were looking for work, a sign of confidence in the labor market.

Fed Chair Janet L. Yellen will make her semi-annual testimony to the US Congress on Wednesday, and investors are expecting the central bank chief to drop further hints on the Fed’s tightening plans.

Harry G. Liu, president of Summit Securities, Inc., said investors are still waiting for catalysts, such as the opening of Congress later this month wherein the Duterte administration’s tax reform package is expected to be discussed, adding that the ongoing infighting in Marawi may be keeping the index from soaring.

Only the financials counter posted gains on Monday, climbing 0.38% or 7.57 points to 1,968.47.

Meanwhile, services fell 1.02% or 17.43 points to 1,684.27; holding firms slid 0.79% or 62.85 points or 7,834.44; industrials dropped 0.64% or 71.48 points to 11,068.44; property edged down 0.54% or 20.04 points to 3,631.24; and mining and oil inched down 0.12% or 15.43 points to 12,594.63.

Losers outnumbered advancers at 104 to 91, while 51 names were unchanged.

Value turnover climbed to P7.07 billion from Friday’s P6.90 billion as 1.65 billion shares changed hands.

Net foreign buying was logged at P35.50 million, a turnaround from the P152.37 million in net selling seen last Friday.

Southeast Asian stock markets edged lower on Monday in lackluster trade, in the absence of immediate catalysts.

On a broader scale, there may be lingering rebalancing flows away from emerging market yield plays after the recent slew of rhetoric from central banks, said Emmanuel Ng, a strategist at OCBC Bank, Singapore. — J.C. Lim with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-slides-as-us-jobs-data-boost-rate-hike-bets&id=148020

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion