Top Ten Smart Money Moves – July 12, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 12, 2016 Data)

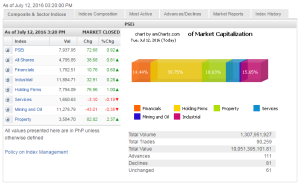

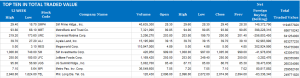

Total Traded Value – PhP 10.036 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 111 Advances vs. 81 Declines = 1.37:1 Neutral

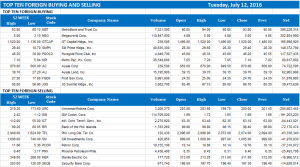

Total Foreign Buying – PhP 4.899 Billion

Total Foreign Selling – (Php 3.935) Billion

Net Foreign Buying (Selling) Php 0.964 Billion – 3rd day of Net Foreign Buying after 1 day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

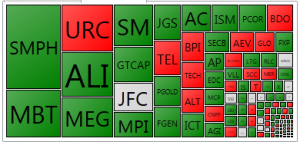

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index edges higher as US stock markets rally

Posted on July 13, 2016

LOCAL EQUITIES edged up on Tuesday as US markets rallied to all-time highs overnight and ahead of the ruling on the Philippines’ arbitration case versus Beijing on the South China Sea.

The bellwether Philippine Stock Exchange (PSE) index rose 0.92% or 72.68 points to 7,937.95 yesterday.

The broader all-shares index climbed 0.81% or 38.68 points to 4,795.85.

“The US’ S&P reached an all-time high based on stronger than expected employment data,” Luis A. Limlingan, managing director of Regina Capital Development Corp., said in a phone interview yesterday.

The Standard & Poor’s 500 ended at a new high after touching its highest of 2,143.16. It overtook the previous highs touched in May 2015, after Friday’s massive job figures reduced worries about a slowdown in employment.

“On the victory of Shinzo Abe, there are expectations that their going to boost stimulus on monetary policy in the Bank of Japan,” Mr. Limlingan added.

“We tracked Wall Street last night, but aside from that, investors are anticipating the Hague [decision],” Ralph Christian G. Bodollo, equity research analyst at RCBC Securities Inc., said in a phone interview.

“Analysts are projecting the arbitration court will rule in favor of the Philippines. So that’s something to cheer about,” Mr. Bodollo added.

After local financial markets closed yesterday, the Permanent Court of Arbitration said it issued a unanimous award to the Philippines on its maritime dispute with China.

Property drove the market’s rise as it gained 2.36% or 82.82 points to 3,584.70. Holding firms rose 0.99% or 76.96 points to 7,794.09; financials rose 0.60% to 10.76 points to 1,792.51; and industrials climbed 0.27% or 32.91 points to 11,884.717.

In contrast, services inched down by 0.18% or 3.10 points to 1,650.63 while mining and oil dipped by 0.38% or 43.01 points to 11,278.79, extending two weeks’ worth of losses.

Mr. Bodollo said the counter’s continued slump was “due to the memo order on the moratorium on new mining projects and expansive audit.”

Advancers beat decliners, 111 to 81, while 61 names ended flat.

Net foreign buying increased to P963.97 million from the P807.62 million seen the previous session. Value turnover was at P10.02 billion, larger than Monday’s P8.02 billion turnover, as 1.31 billion shares changed hands.

Most Southeast Asian stock markets were also higher on Tuesday, in line with Asian peers, enjoying spillover gains from Wall Street’s record high aided by upbeat US jobs data and expectations of stimulus from global policy makers.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.5% to its highest since April.

Investors will also keep a close eye on the Bank of Japan as Japanese Prime Minister Shinzo Abe ordered a new round of fiscal stimulus spending after a crushing election victory. — J.C. Lim with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-edges-higher-as-us-stock-markets-rally&id=130308

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion