Top Ten Smart Money Moves – July 25, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 25, 2016 Data)

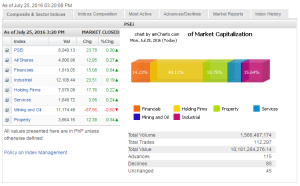

Total Traded Value – PhP 10.181 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 115 Advances vs. 85 Declines = 1.35:1 Neutral

Total Foreign Buying – PhP 4.750 Billion

Total Foreign Selling – (Php 4.116) Billion

Net Foreign Buying (Selling) Php 0.634 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

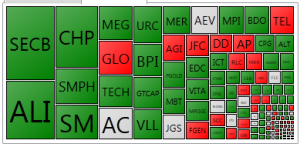

PSE HEAT MAP

Screenshot courtesy of PSEGET

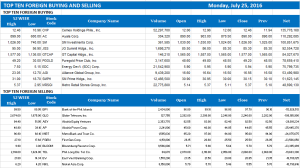

Top Ten Foreign Buying and Selling

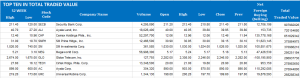

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi climbs on bullish sentiment ahead of SONA

Posted on July 26, 2016

LOCAL EQUITIES climbed on Monday due to confidence among investors that President Rodrigo R. Duterte would lay down favorable policies for business in his State of the Nation Address (SONA), which happened after the market’s close.

The benchmark Philippine Stock Exchange index (PSEi) increased 0.29% or 23.78 points to 8,049.13. The broader all-shares index jumped 0.27% or 12.95 points to 4,806.98.

“Early in the day we had a surge as stock prices rallied due to anticipation of later’s SONA… I think investors were anticipating a positive pronouncement from [Mr.] Duterte for businesses,” Ralph Christian G. Bodollo, equity research analyst at RCBC Securities Inc., said in a phone interview.

The bellwether PSEi reached an intraday high of 8,114.34, below the firm’s projected resistance of 8,118 points amid the lack of catalysts to push the market higher, Mr. Bodollo said.

“I think markets are finishing positive. We still sold some of our profit from our intraday high as people are waiting for the BoJ (Bank of Japan) meeting as well as the Fed[eral Reserve],” Luis A. Limlingan, managing director at Regina Capital Development Corp., said in an interview.

Mr. Limlingan added that investors continued to take their cue from corporate earnings.

Of the six subindices, only mining and oil finished in negative territory, dipping 0.60% or 67.56 points to 11,174.49.

Financials gained the most, rising 0.83% or 15.08 points to 1,819.05. Property rose 0.33% or 12.38 points to 3,664.16; services increased 0.24% or 3.95 points to 1,649.72; holding firms climbed 0.22% or 17.76 points to 7,978.09; and industrials went up 0.19% or 23.51 points to 12,108.44.

Advancers topped decliners, 115 to 85, while 45 names were unchanged.

Foreigners were net buyers with purchases reaching P633.95 million, a turnaround from Friday when foreigners were net sellers for the first time in 10 sessions, with net selling at P73.87 million

Value turnover reached P10.18 billion, higher than Friday’s level of P7.75 billion as 1.57 billion shares changed hands.

Most other Southeast Asian stock markets also rose ahead of a two-day Fed meeting starting on Tuesday and a Bank of Japan meeting at the end of the week.

The Fed is expected to keep its policy rate unchanged at the two-day meeting, but investors will be closely parsing its statement for clues on policy direction.

Meanwhile, the Bank of Japan is expected to ease policy later this month, according to a majority of economists polled by Reuters.

Indonesian stocks rebounded from Friday’s losses, led by telecoms and consumer cyclicals. Cigarette-maker Hanjaya Mandala Sampoerna Tbk PT gained 1.3%, while Astra International Tbk PT rose 1%.

Bucking the trend, Singapore’s Straits Times Index fell 0.2%, dragged down by consumer goods and consumer services stocks, Reuters reported. — Janina C. Lim with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-climbs-on-bullish-sentiment-ahead-of-sona&id=130926

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion