Top Ten Smart Money Moves – July 29, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 29, 2016 Data)

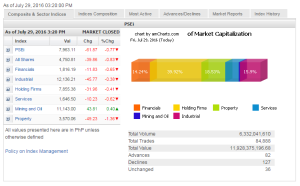

Total Traded Value – PhP 11.928 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 127 Declines vs. 82 Advances = 1.55:1 Neutral

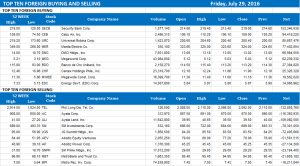

Total Foreign Buying – PhP 4.212 Billion

Total Foreign Selling – (PhP 4.252 Billion

Net Foreign Buying (Selling) (PhP 0.040) Billion – 1ST day of Net Foreign Selling after 4 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

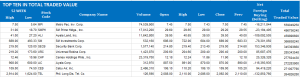

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks retreat for second day

Posted on July 30, 2016

LOCAL EQUITIES plunged for a second straight day on Friday, joining a retreat across much of Asia after the Bank of Japan (BoJ) failed to meet expectations of stronger stimulus measures.

The bellwether Philippine Stock Exchange index pulled back 0.77% or 61.87 points to end 7,963.11, while the broader all-shares index slipped 0.83% or 39.86 points to 4,750.81.

The benchmark index was down 0.78% on the week.

All but one sectoral index ended the day in the red.

Reuters reported that BoJ expanded stimulus on Friday by doubling purchases of exchange-traded funds, but disappointing investors who had expected even stronger measures.

Most Asian markets retreated, with the MSCI Asia APEX 50 shedding 0.94%.

Shanghai Composite Index, Hang Seng, Mubai Sensex and Taiwan TXEC 50 Index lost 0.50%, 1.28%, 0.56% and 1.02%, respectively, while the Nikkei 225 managed to edge up 0.56%.

Most other Southeast Asian bourses also sounded the retreat, with FTSE Bursa Malaysia KLCI, Jakarta Composite Index, Straits Times Index and Thai SET 50 Index falling 0.32%, 1.57%, 1.71% and 0.28%, respectively.

“There was the news of the Bank of Japan maintaining stimulus,” Luis A. Limlingan, managing director at Regina Capital Development Corp., said in a telephone interview, adding that the investors locked in profits for the month-end window-dressing.

Victor F. Felix, equity analyst at AB Capital Securities, Inc., shared this reading, saying separately by phone: “I think it was a mixture of profit-taking and Japan: they released their lesser-than-expected stimulus package — a third of what was expected. A lot of people were expecting more stimulus but Japan disappointed.”

Investors are also starting to digest the hawkish tone of the Federal Reserve which last Wednesday signaled the prospect of rate hikes towards yearend after keeping policy steady in the wake of December’s increase — the first in nearly a decade, according to Mr. Felix.

Among the six sectoral indices, only mining and oil increased, edging up 43.81 points or 0.40% to finish the day at 11,143.

Property saw the biggest losses of 1.36% or 49.23 points to 3,570.06. Financials slumped 0.65% or 11.83 points to 1,816.19, services fell 0.62% or 10.23 points to 1,646.50, holding firms slid 0.41% or 31.96 points to 7,855.38, while industrial pulled back 0.38% or 45.77 points to 12,136.21.

“I think commodity prices are continuing to recover from the low seen in February. A lot of mining companies should be releasing relatively good second-quarter results despite the whole audit by the DENR (Department of Environment and Natural Resources),” AB Capital’s Mr. Felix added.

Decliners outnumbered advancers, 127 to 82, while 36 names ended unchanged.

Foreigners turned bearish, ending the day with P40.154 million in net selling against Thursday’s P858.356 million net buying.

Value turnover reached P11.928 billion, compared to Thursday’s P10.14 billion, as 6.332-billion shares changed hands. — Janina C. Lim

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-retreatbr-for-second-day&id=131167

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion