Top Ten Smart Money Moves – July 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 4, 2016 Data)

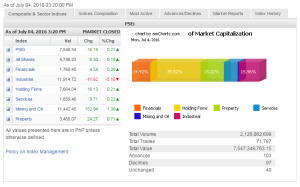

Total Traded Value – PhP 7.547 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 103 Advances vs. 97 Declines = 1.06:1 Neutral

Total Foreign Buying – PhP 3.279 Billion

Total Foreign Selling – (Php 2.763) Billion

Net Foreign Buying (Selling) Php 0.516 Billion – 4th day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

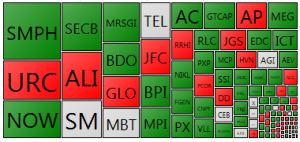

PSE HEAT MAP

Screenshot courtesy of PSEGET

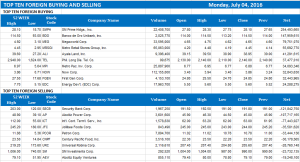

Top Ten Foreign Buying and Selling

and Selling

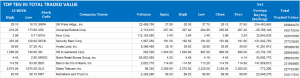

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks rise to track regional marts ahead of Fed

Posted on July 05, 2016

LOCAL STOCKS moved up in anticipation of the release of the minutes of the latest meeting of the Federal Open Market Committee (FOMC) and with US markets closed for a holiday.

The bellwether Philippine Stock Exchange index climbed by 0.20% or 16.19 points to close at 7,846.54 on Monday.

The broader all shares index finished at 4,746.33, up 0.17% or 8.30 points.

“Asian stocks entered the week rather meekly as trades in the wider Asia-Pacific region opened amid a still uncertain weekend election result in Australia. Philippine shares however managed to buck the trend as it opened on the high side.,” said A&A Securities Inc., in a statement.

“US markets were closed and Asian markets were trading positively since they were waiting for the FOMC minutes of the meeting,” Luis A. Limlingan, managing director of Regina Capital Development Corp. said in a phone interview.

“The US market rose and the other markets followed,” said research head at Unicapital Securities, Inc., Lexter L. Azurin over the phone.

Mr. Azurin added that dissipating concerns of an economic fallout after the United Kingdom’s vote to leave the European Union and the growing probability of a delay in the Federal Reserve’s planned increase in interest rates may have contributed to the market’s rise.

Most subindices ended higher. The mining and oil counter led the charge as it gained 1.35% or 152.94 points to 11,442.48.

Mr. Azurin attributed the sector’s gains to the recovery of global commodity prices for the past few days.

This was followed by property, which rose 0.70% or 24.27 points to 3,468.07. Financials increased 0.26% or 4.59 points to 1,768.40; services gained 0.22% or 3.71 points to 1,659.46 points; and holding firms went up 0.21% or 16.13 points to 7,664.04.

The industrial counter was the lone counter in the red as it declined by 0.10% or 11.92 points to 11,914.72.

“I think the administration wants to clamp down on several industries din,” Regina Capital’s Mr. Limlingan said, adding that investors may have seen possible risk of the government’s plan to review industrial companies.

Advancers beat decliners, 103 to 97, respectively, while 40 names were unchanged.

Value turnover dropped to P7.55 billion on Monday from Friday’s P11.16 billion, with 2.13 billion shares changing hands.

Foreigners remained net buyers, but net purchases declined to P515.64 million from Friday’s P1.97 billion.

Southeast Asian stock markets were trading higher on Monday, tracking broader Asian shares, while activity across much of the region was subdued due to the US Independence Day holiday.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.6% after Wall Street logged its fourth straight day of gains on Friday. Investors are awaiting a raft of data this week including US non-farm payroll numbers due on Friday. — J. C. Lim

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-rise-to-track-regional-marts-ahead-of-fed&id=129913

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion