Top Ten Smart Money Moves – July 5, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 5, 2016 Data)

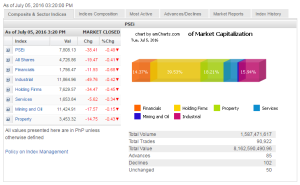

Total Traded Value – PhP 8.162 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 102 Declines vs. 85 Advances = 1.20:1 Neutral

Total Foreign Buying – PhP 3.939 Billion

Total Foreign Selling – (Php 3.006) Billion

Net Foreign Buying (Selling) Php 0.933 Billion – 5th day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

and Selling

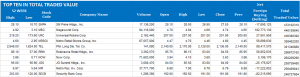

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

June FOMC minutes in focus as market reopens

Posted on July 07, 2016

UNCERTAINTY looms for local equities as the market reopens on Thursday, with its performance heavily dependent on the release of the minutes of the meeting of the Federal Open Market Committee (FOMC), seen to either lift or further depress trading amid concerns on a possible fallout from United Kingdom’s recent vote to leave the European Union.

“I think the stock market will follow the release of the FOMC minutes of the meeting later tonight. I think that is one of the factors investors will follow,” said Ralph Christian G. Bodollo, equity research analyst at RCBC Securities, Inc. in a phone interview on Wednesday.

“If US markets close low, we can go downwards… we’ll break 7,800 [points],” said Luis A. Limlingan, managing director of Regina Capital Development Corp.

The bellwether Philippine Stock Exchange closed Tuesday to 7,808.13 points, down by 38.41 points or 0.49%.

Renewed fears over the “Brexit” may be a contributing factor to Thursday’s stock movement, according to Mr. Limlingan, due to the fall of the British pound versus US dollar.

On Tuesday, the trading of pound sterling fell to $1.3 to a dollar, the lowest in 31 years.

“The valuations of the PSEi are not in a comfortable level… We’ll continue to have some profit taking. We also lack the fundamental catalysts. So investors will focus on valuation and will rationalize holdings,” RCBC Securities’ Mr. Bodollo added.

Regina Capital’s Mr. Limlingan said that amid concerns over a impact of Britain’s vote on the global economy, sentiment may get a boost from the FOMC minutes.

“Generally, I think there’s no negative sentiment… If we can negate that…we can still trade upwards,” Mr. Limlingan added.

Meanwhile, for the rest of Asia, Vietnam shares retreated on Wednesday after hitting an eight-year high in the previous session as investors booked profits, while Thailand was marginally down.

But activity across much of the region was subdued as most markets were closed for Eid’l Fitr.

Asian share markets turned tail as fears over instability in the European Union returned with a vengeance, sending the pound to three-decade lows and hammering risky assets of all stripes.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 1.7% at 0420 GMT.

Investors rushed to safe-haven assets such as sovereign debt and gold. Gold climbed to its highest in more than two years early on Wednesday.

Vietnam’s benchmark stock index was down 0.2% after seven sessions of gains. Thai shares were headed for their second straight loss after five sessions of gains. Investors are trading to “take profit” for a while, said an analyst with KGI Securities.

Thailand, adding that the “Thai market will perform above 1,450 points.”

Indorama Ventures Pcl rose 2.6%, while PTT PCL fell nearly 1%.

Singapore, Malaysia and Indonesia stock markets were also closed on Wednesday for Eid’l Fitr. — JCL with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=june-fomc-minutes-in-focus-as-market-reopens&id=130027

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion