Top Ten Smart Money Moves – June 17, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 17, 2016 Data)

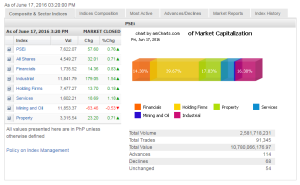

Total Traded Value – PhP 10.780 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 114 Advances vs. 68 Declines = 1.68:1 Neutral

Total Foreign Buying – PhP 10.780 Billion

Total Foreign Selling – (Php 7.885) Billion

Net Foreign Buying (Selling) Php 1.406 Billion – 2nd day of Net Foreign Buying after 4 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

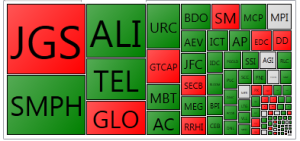

PSE Heat Map

Screenshot courtesy of: PSEGET Software

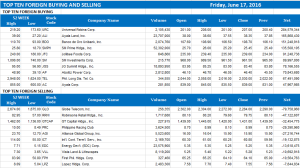

Top Ten Foreign Buying and Selling

and Selling

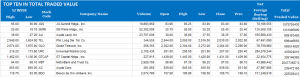

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 18, 2016 12:29:00 AM

BY Keith Richard D. Mariano

Stocks end volatile week on a high note

THE LOCAL stock barometer advanced for a third consecutive session on Friday, as bright prospects for the Philippine economy cast off worries over global uncertainties, particularly the United Kingdom’s possible exit from the European Union.

The Philippine Stock Exchange index (PSEi) closed 57.60 points or 0.76% higher at 7,622.07, outperforming most markets in Southeast Asia. Week on week, the bellwether gained 112.13 points or 1.49% from its 7,509.94 finish on June 10.

The broader all-shares index, meanwhile, ended at 4,549.27 after gaining 32.01 points or 0.71%.

Industrial stocks led other counters, rallying by 179.05 points or 1.54% to 11,841.79. The market also saw services climb by 18.69 points or 1.18% to 1,602.21; financials by 14.36 points or 0.83% to 1,735.52; property by 23.20 points or 0.71% to 3,315.54; and holding firms by 13.70 points or 0.18% to 7,477.27.

Mining and oil stocks bucked the uptrend after declining 63.46 points or 0.53% to 11,853.37.

“Markets, I think, have opened stronger on the back of better performance on Wall Street,” Eagle Securities, Inc. President Joseph Y. Roxas said in a telephone interview.

The PSEi stayed within the 7,600 territory throughout the day, opening at 7,607.95 and reaching its intraday high of 7,656.33 within the first hour of trading. Its lowest point was 7,607.95.

The benchmark S&P 500 index that ended a five-day losing streak on Thursday after a British lawmaker’s murder caused the suspension of campaigning for the June 23 referendum there, foreign media reported.

Mr. Roxas said the outcome of the UK referendum should have minimal impact, if any, on the Philippine economy although speculations have nevertheless moved markets.

“We’re bullish… we are expected to outperform anybody else,” Mr. Roxas noted.

Also, the United States Federal Reserve’s decision to keep interest rates unchanged continued to buoy investor sentiment, Nisha S. Alicer, chief equity analyst at DA Market Securities, Inc., said in a separate telephone interview.

“Investors are still neutral on the ‘Brexit’ because some are saying such a move is good, some say it will be bad and there are also others saying it’s not going to be a big deal,” Ms. Alicer added.

Ms. Alicer further noted that “bullishness” toward the Philippine economy’s prospects remains, making local stocks attractive to investors.

Value turnover almost doubled to P10.78 billion, from the previous session’s P5.92 billion, after 2.58 billion shares exchanged hands. Advancers led decliners, 114 to 68, while 54 were unchanged.

Foreign investors were net buyers, taking stocks worth P1.41 billion more than what they sold during the session.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-end-volatile-week-on-a-high-note&id=129168

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion