Top Ten Smart Money Moves – June 20, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 20, 2016 Data)

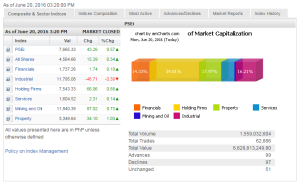

Total Traded Value – PhP 6.629 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 99 Advances vs. 97 Declines = 1.02:1 Neutral

Total Foreign Buying – PhP 3.242 Billion

Total Foreign Selling – (Php 2.888) Billion

Net Foreign Buying (Selling) Php 0.354 Billion – 3rd day of Net Foreign Buying after 4 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

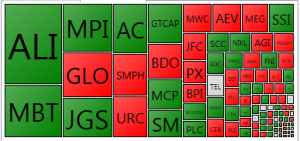

PSE Heat Map

Screenshot courtesy of: PSEGET Software

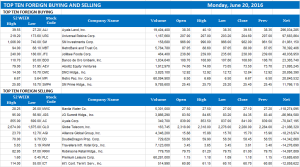

Top Ten Foreign Buying and Selling

and Selling

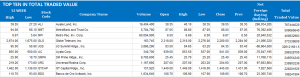

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 20, 2016 06:56:00 PM

By Krista A. M. Montealegre, National Correspondent

PSEi extends winning run as ‘Brexit’ fears wane

LOCAL EQUITIES sustained on Monday their bullish momentum since last week, as fears on the upcoming United Kingdom (UK) referendum abated after weekend polls indicated a swing in favor of the country remaining in the European Union (EU).

The benchmark Philippine Stock Exchange index (PSEi) drifted higher by 43.26 points or 0.56% to close at 7,665.33, extending its winning run to a fourth session. The broader all-shares index rose 15.39 points or 0.33% to end at 4,564.66.

“Increased investor confidence was due to easing ‘Brexit’ concerns. If the UK stays in the EU, the PSEi might breakthrough to the 7,800 level with downside risk at 7,480,” Joylin F. Telagen, equity analyst at IB Gimenez Securities, said in a mobile phone message.

Three opinion polls published on Saturday showed that the campaign to stay in the 28-member bloc has gained momentum ahead of the EU membership referendum on June 23.

Global markets have been pummeled by “Brexit” fears in previous weeks, but the Philippine equities have remained resilient amid the country’s strong economic growth prospects.

“You can attribute that to the strong performance of the domestic economy in the first quarter and that lingered in the minds of investors following indications from the Federal Reserve in terms of going back to the rate hike cycle,” AB Capital Securities, Inc. Head of Research Jose A. Vistan, Jr. said by phone.

The domestic economy grew 6.9% annually in the first three months of this year, fueled by robust domestic consumption and election-related spending.

Most counters finished in the green, with property leading the way after climbing 34.10 points or 1.02% to 3,349.64.

Holding firms advanced 66.06 points or 0.88% to 7,543.33; mining and oil jumped 87.02 points or 0.73% to 11,940.39; services inched up 2.31 points or 0.14% to 1,604.52; and financials rose 1.74 points or 0.1% to 1,737.26.

Industrial was the lone sub-index in the red, losing 46.71 points or 0.39% to 11,795.08.

Value turnover slumped to P6.63 billion yesterday from P10.78 billion on Friday, after 1.56 billion shares changed hands.

Advancers edged out decliners, 99 to 97, while 51 issues were unchanged.

Foreign investors remained in buying territory, but the value of their purchases declined to P353.62 million from P1.41 billion in the previous session.

“We believe that market may take its time in the next week-or-so as we move into the period when government changes hands,” Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said in a report. “Nevertheless, against certain odds, we stick to our positive bias in our outlook for the market — unless substantial surprises emerge, particularly on the political front.”

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-extends-winning-run-as-&145brexit&8217-fears-wane&id=129228

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion