Top Ten Smart Money Moves – June 9, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 9, 2016 Data)

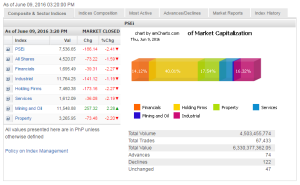

Total Traded Value – PhP 6.330 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 122 Declines vs. 74 Advances = 1.65:1 Neutral

Total Foreign Buying – PhP 2.117 Billion

Total Foreign Selling – (Php 1.928) Billion

Net Foreign Buying (Selling) Php 0.189 Billion – 12th day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

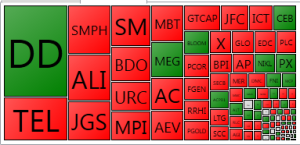

PSE Heat Map

Screenshot courtesy of: PSEGET Software

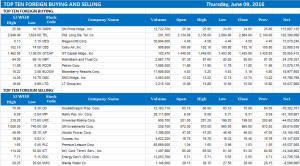

Top Ten Foreign Buying and Selling

and Selling

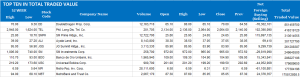

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 09, 2016 08:48:00 PM

Stocks down as investors pocket gains from rally

STOCKS plunged to the 7,500 level, erasing most gains from a four-day rally, as investors took profits and became risk averse toward developments abroad.

The benchmark Philippine Stock Exchange index (PSEi) dropped by 186.14 points or 2.41% to 7,536.65.

The broader all-shares index, meanwhile, declined by 73.22 points or 1.59% to 4,520.07.

The main index had rallied for four consecutive sessions — climbing 258.20 points to breach the 7,700 mark for the first time this year — before retreating on Thursday.

The PSEi managed to advance to 7,725.55 when the market opened on Thursday. This was already the highest point the index managed to reach during the session.

“Investors opted to take profit after several days of gains in the market,” First Grade Finance, Inc. Managing Director Astro C. del Castillo said in a text message.

“Most preferred to unload their blue chips. It seems like the market is poised to take a breather in the coming days,” Mr. del Castillo added.

More than 4.5 billion shares worth P6.33 billion exchanged hands on Thursday.

The volume more than doubled from the 2.08 billion shares worth P10.02 billion traded on Wednesday.

Only mining and oil sub-index managed to stay in the green, gaining 257.32 points or 2.28% to 11,548.88.

All other counters dropped, with holding firms and financials dropping 2.26% each to close at 7,460.38 and 1,695.49, respectively. The property counter slipped 73.48 points or 2.2% to 3,265.95; services gave up 36.08 points or 2.18% to end at 1,612.09; and industrials went down 141.12 points or 1.18% to 11,764.25.

Decliners trumped advancers, 122 to 74, while 47 issues remained steady. Net foreign buying plunged to P189.04 million from the P1.93 billion in net purchases seen on Wednesday.

“The region in general slid [Thursday] as well as the rest of the global markets,” Angping & Associates Securities, Inc. equity trader Frank Gerard J. Barboza noted in a text message.

Risk aversion also pulled the market aside from profit-taking, Mr. Barboza said, noting that investors were “fearful” of the potential exit of the United Kingdom from the European Union.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said such a development could weaken the creditworthiness of the EU.

Mr. Limlingan noted that investors also await the outcome of the policy meetings of the US Federal Reserve and the Bank of Japan next week.

“Expect more volatility in the coming days as international developments happen while there is a lack of market-moving news in local market. Earnings season still far and enthusiasm post-election slowing down,” Angping & Associates’ Mr. Barboza said.

The PSEi could test the 7,500 support level although it continues to take an uptrend, Regina Capital’s Mr. Limlingan said. — K.R.D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-down-as-investors-pocket-gains-from-rally&id=128796

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion