Top Ten Smart Money Moves – Mar. 9, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

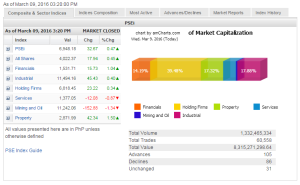

Trading Notes for Today – (Based on Mar. 9, 2016 Data)

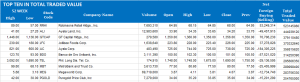

Total Traded Value – PhP8.315 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 105 Advances vs. 86 Declines = 1.22:1 Neutral

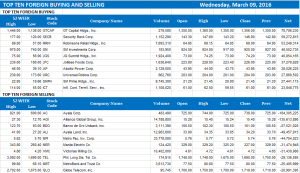

Total Foreign Buying – PhP 4.360 Billion

Total Foreign Selling – (Php 4.694) Billion

Net Foreign Buying (Selling) – (Php 0.334) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

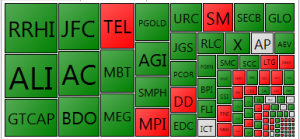

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on March 09, 2016 09:21:00 PM

By Krista A. M. Montealegre, Senior Reporter

Stocks recoup early losses on bullish prospects

EQUITIES RECOVERED from a morning session slump to eke out gains for a second straight day, as investors betting on the upbeat prospects of the domestic economy took advantage of the stock market’s intraday weakness to position on select stocks.

The bellwether Philippine Stock Exchange index (PSEi) rose 32.67 points or 0.47% to end at 6,948.18, near the session’s high. The benchmark index fell by as much as 0.37%. The all-shares index advanced 17.94 points or 0.44% to finish at 4,022.37.

“The character of the market at present is such that there is sufficient confidence on the resilience of the domestic economy to withstand external shocks even as attention remains heightened and reactions sensitive to headwinds,” Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said in a report.

Earnings have failed to push the stock market either way except in the case of Philippine Long Distance Telephone Co., which weighed on the PSEi last week after lackluster results, Mr. Calaycay said, noting that most firms’ numbers have registered “marginal changes to nearly flat.”

In Asia, weak trade data from China and a retreat in oil prices revived concerns on the health of the global economy, dragging equities from two-month highs.

China’s February trade data showed exports dropped 25.4% year on year and imports fell 13.8%, worse than figures expected by analysts.

“I think it is rotational buying. The foreign funds are coming in, with China falling after the weak trade data, commodities are down, and oil also sank so they are switching to Philippine equities,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a telephone interview.

Property gained 42.34 points or 1.49% to 2,871.99 and financials went up 15.73 points or 1.03% to 1,531.71, leading the stock market higher. Likewise, industrial added 45.43 points or 0.39% to 11,494.16 and holding firms inched up 23.22 points or 0.34% to 6,818.45.

In contrast, mining and oil declined 152.88 points or 1.34% to 11,242.06 and services dropped 12.08 points or 0.87% to 1,377.05.

Value turnover increased to P8.32 billion after 1.33 billion shares changed hands, from Tuesday’s P6.38 billion.

Advancers beat decliners, 105 to 86, while 31 issues were unchanged.

Foreigners turned sellers, with net outflows totaling P334.22 million, a reversal of the previous day’s net purchases worth P752.96 million.

Investors will be closely monitoring domestic exports data due today, setting the tone for the direction of trades.

“We could move sideways to downward. We’ve been rallying and we haven’t been able to breach 6,950. That’s going to be a tough psychological resistance level,” Regina Capital’s Mr. Limlingan said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-recoup-early-losses-on-bullish-prospects&id=124296

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion