Top Ten Smart Money Moves – March 10, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on March 10, 2017 Data)

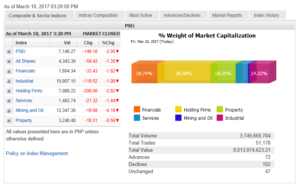

Total Traded Value – PhP 8.013 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 102 Declines vs. 72 Advances = 1.42:1 Neutral

Total Foreign Buying – PhP 3.638 Billion

Total Foreign Selling – (PhP 4.256 Billion)

Net Foreign Buying (Selling) – (PhP 0.618 Billion) – 3rd day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

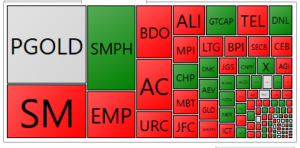

PSE HEAT MAP

Screenshot courtesy of PSEGET

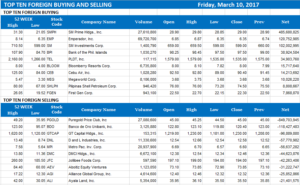

Top Ten Foreign Buying and Selling

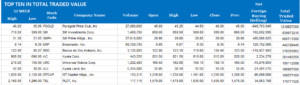

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks to remain weak ahead of FOMC meeting

Posted on March 13, 2017

STOCKS may move sideways this week with a downward bias as investors wait for the US Federal Reserve meeting, where a rate hike is almost certain, to get a clearer view of the central bank’s pulse on the US economy.

The bellwether Philippine Stock Exchange index (PSEi) gave up 149.18 points or 2.04% to finish at 7,146.27 on Friday.

Week on week, the main index lost 1.39% compared to its 7,247.12 finish last March 3.

The index was dragged lower by losses in holding firms (down 3.51%), while services managed to register a 3% gain, as PLDT, Inc.’s decline was offset by mid-week buying, since investors factored in results for 2016.

Net foreign selling prevailed although at a slower pace at P11 million from the prior week’s P494 million. Losers outnumbered gainers at 98 and 85, respectively.

“Attention will revert to the FOMC’s (Federal Open Market Committee) meeting this week, even as fund managers have seemingly priced in the possibility of [a] rate hike. What should be underscored is the extent at which FOMC officials will acknowledge the pace of US economic growth, starting with labor data expansion, said online brokerage 2TradeAsia.com in its weekly market outlook e-mailed to reporters over the weekend.

Fed Chair Janet L. Yellen signaled two weeks ago that the US central bank would likely hike rates at its March 14-15 policy meeting. Rising inflation, together with a tighter labor market, stock market boom and strengthening global economy, has left some economists expecting that the Fed could increase rates much faster than currently anticipated by financial markets.

The US central bank lifted its benchmark overnight rate in December and has forecast three rate increases for 2017.

Expectations the Fed will hike rates this week rose to 92% after the jobs report released last Friday, according to Thomson Reuters data. Nonfarm payrolls rose by 235,000 jobs as the construction sector recorded its largest gain in nearly a decade due to unseasonably warm weather, the US Labor Department said.

“Most investors have already discounted that a rate hike will be announced when the Fed officials convene,” said Luis A. Limlingan, managing director at Regina Capital Development Corp. via text.

Mr. Limlingan said markets will look to other US data due out this week for trading leads, as well as the conclusion of China’s National People’s Congress conclusion and developments in Europe ahead of the Fed meeting.

Also, although US President Donald J. Trump has yet to unveil a more detailed blueprint to execute his economic package this year, investors are seen to remain on the sidelines until fiscal stimulus measures are announced.

“If this view is supported, we may see the greenback strengthening with peer currencies on the reverse side. Most might also track local monetary authorities’ revised stance on borrowing costs, and its effect on listed companies’ earnings growth,” added 2TradeAsia.com. — JCL with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-to-remain-weak-ahead-of-fomc-meeting&id=142027

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion