Top Ten Smart Money Moves – March 31, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on March 31, 2017 Data)

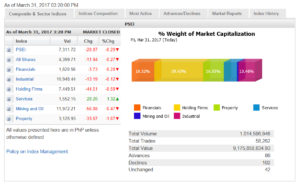

Total Traded Value – PhP 9.176 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 79 Declines vs. 65 Advances = 1.22:1 Neutral

Total Foreign Buying – PhP 5.486 Billion

Total Foreign Selling – (PhP 5.481 Billion)

Net Foreign Buying (Selling) – PhP 0.0050 Billion – first day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

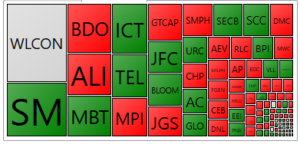

PSE HEAT MAP

Screenshot courtesy of PSEGET

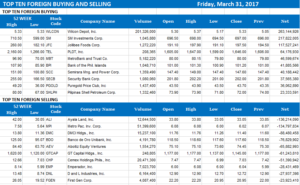

Top Ten Foreign Buying and Selling

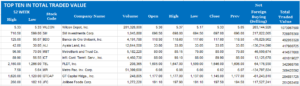

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks to trade sideways ahead of Fed minutes

Posted on April 03, 2017

THE MARKET is expected to continue trading sideways this week as investors search for catalysts, with focus turning to hints on the US Federal Reserve’s next move and the Trump administration’s reform plans.

The Philippine Stock Exchange index closed at 7,311.72 points on Friday, 42.10 points higher than its 7,269.62 close last March 24 amid end-quarter rebalancing among investors.

Most sectors finished in positive territory, led by services which increased by 3%.

Losers trumped gainers 94 to 87 with a P7-billion value turnover last week.

Averaged net foreign outflow climbed to P1.3 billion.

“With concerns brewing on the capability of the current US administration to implement the tax reform overhaul, eyes are set on how the Fed will counter this hurdle in terms of monetary policies,” read the weekly report of online brokerage 2TradeAsia.com.

2TradeAsia.com said the minutes of the Fed’s March 14-15 meeting, due for release on Wednesday, will be in the spotlight this week, with investors watching out for clues on how the US central bank will move forward following last month’s rate increase.

Investors will also be watch out for US data on inflation and employment while also keeping an eye on developments in the United Kingdom following its filing of a formal notice to leave the European Union.

“The market is still poised to trade sideways as investors are in search for any catalysts to propel the market higher,” Luis A. Limlingan, managing director at Regina Capital Development Corp., said in a mobile message over the weekend.

2TradeAsia.com also noted that market players are also watching the selection process for the next Bangko Sentral ng Pilipinas (BSP) chief. The government plans to announce its next central bank governor in three or four weeks’ time, Finance Secretary Carlos G. Dominguez III told Reuters last Wednesday.

Speculation has been rife at to who will succeed BSP Governor Amando M. Tetangco, Jr. who is due to step down in July, after having completed the maximum allowed two terms.

Names that have been floated include BSP deputy governors Diwa C. Guinigundo and Nestor A. Espenilla, Jr., as well as former trade secretary and monetary board member Peter B. Favila.

“We have already initiated interviews with potential candidates,” Mr. Dominguez said, when asked if the government was making progress in selecting a new governor. “We are pretty much according to schedule and we should be making an announcement in three or four weeks’ time.”

President Rodrigo R. Duterte will make the appointment.

“The market would need to break away from its present sideways trend, which might gain positive traction as [US] economic stimulus measures are announced,” 2TradeAsia.com added, pegging resistance at 7,400 and support at 7,250. — J.C. Lim with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-to-trade-sideways-ahead-of-fed-minutes&id=143129top

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion