Top Ten Smart Money Moves – May 10, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 10, 2016 Data)

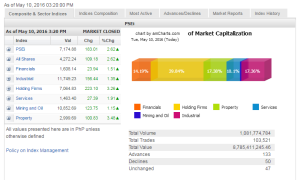

Total Traded Value – PhP 8.785 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 133 Advances vs. 50 Declines = 2.66:1 Bullish

Total Foreign Buying – PhP 4.876 Billion

Total Foreign Selling – (Php 5.573) Billion

Net Foreign Buying (Selling) (Php 0.697) Billion – 3rd day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

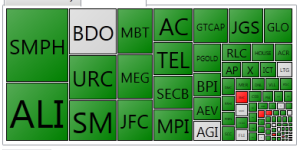

PSE Heat Map

Screenshot courtesy of: PSEGET Software

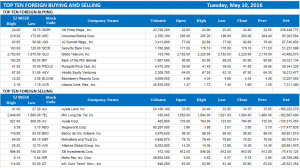

Top Ten Foreign Buying and Selling

and Selling

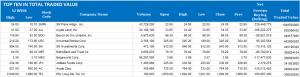

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 10, 2016 08:23:00 PM

PSEi rises as investors cheer ‘peaceful’ elections

STOCKS surged on Tuesday amid the perception that the elections went generally well without major glitches, with the lead of the likely winning presidential candidate way ahead of the other contenders.

The bellwether Philippine Stock Exchange index jumped 183.01 points or 2.06% to close at 7,174.88, while the broader all-shares index shot up by 109.18 points or 2.21% to finish at 4,272.24.

“The market reacted favorably to the peaceful and orderly conduct of the election,” said Astro C. del Castillo, managing director at First Grade Finance, Inc.

“Most were also comfortable with the leading candidate, which is President [Rodrigo] Duterte,” he added.

“The value turnover was quite big so things like the upsurge of the market could continue until [today],” he said. “Basically, you would see a rally every time there is an orderly conduct of the polls… It’s really not surprising that the market surged… It’s a welcome development.”

Value turnover hit P8.79 billion with total volume reaching more than a billion, up from the P7.27 billion recorded the previous session.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said investors were relieved that the electoral process was mostly peaceful and “free of widespread cheating.”

Mr. Limlingan added that “the main protagonist has a commanding lead, paving for a peaceful transition.”

With 90% of polling stations reporting, Mr. Duterte was said to have cornered 39% of the ballots cast during the May 9 polls. His closest rival, former Interior Secretary Manuel A. Roxas II, got 23% of the votes. Another presidential candidate Grace Poe, who was in third place during an early count, was the first to concede.

“Regionally, the Philippines followed the rest of Asia as Japan resumed trading after the Golden week,” Mr. Limlingan said. “Japanese shares rose by the most in three weeks as the yen extended its decline, boosting the profit outlook for exporters, and investors bought stocks in companies posting positive earning results.”

He said Chinese stocks in Hong Kong headed for their first gain in seven days as financial companies advanced. “China Minsheng Banking Corp. increased the most in three weeks. The Shanghai Composite Index closed little-changed after data showed China’s consumer prices rose for a third month, while factory-gate deflation narrowed more than expected,” he added.

All sectoral counters ended in the green, with property leading the charge after gaining 3.3% or 100.83 points to 2,999.69.

Advancers numbered 133 against 50 decliners. A total of 47 stocks were unchanged.

Net foreign selling rose to P697.13 million from P611.89 million last Friday.

First Grade’s Mr. del Castillo said there might be a follow-through buying on Wednesday’s trading that could push the main index even beyond the 7,000 level. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-rises-as-investors-cheer-&145peaceful&8217-elections&id=127287

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion