Top Ten Smart Money Moves – May 11, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 11, 2016 Data)

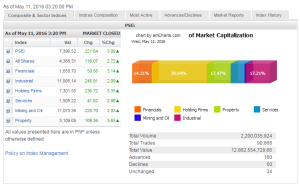

Total Traded Value – PhP 12.862 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 160 Advances vs. 50 Declines = 3.20:1 Bullish

Total Foreign Buying – PhP 8.189 Billion

Total Foreign Selling – (Php 6.312) Billion

Net Foreign Buying (Selling) Php 1.877 Billion – 1st day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

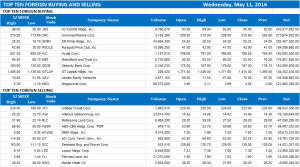

Top Ten Foreign Buying and Selling

and Selling

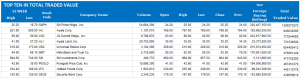

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 11, 2016 07:09:00 PM

PSEi nears 7,400 mark as election jitters subside

THE BELLWETHER Philippine Stock Exchange index (PSEi) extended its post-election rally to soar close to 7,400 on Wednesday as partial results of the May 9 polls indicated a clear presidential winner in Rodrigo R. Duterte as his close contenders earlier conceded defeat.

The business community is also coming to terms with the election’s outcome and digesting early information about Mr. Duterte’s economic plans, including the possibility of easing the entry of foreign investments.

“The possible lifting of foreign ownership in [some sectors]… this has been warmly received by foreign investors,” said Alexander Adrian O. Tiu, of AB Capital Securities, Inc.

On Thursday, the main index gained 221.64 points or 3.08% to close at 7,396.52, while the broader all-shares index surged 116.07 points or 2.71% to end at 4,388.31.

All six sectoral indices finished stronger, with property companies taking the lead with gains of 109.36 points or 3.64% to 3,109.05. Holding firms advanced by 236.72 points or 3.35% to 7,301.55; while financials went up by 50.56 points or 3.14% to 1,658.70.

Services went up by 41.82 points or 2.85% to 1,505.22; industrials rose by 245.91 points or 2.09% to 11,995.14; while mining and oil inched up by 220.70 points or 2.03% to 11,073.39.

Value turnover hit P12.86 billion on total trades of 2.20 billion shares, surging from the P8.79 billion seen the day prior.

Advancers outpaced decliners, 160 to 50. A total of 34 stocks finished unchanged.

Mr. Tiu said foreign investors’ positive response could be seen as foreigners turned net buyers. Net foreign buying was at P1.88 billion yesterday, a reversal of Tuesday’s net sales worth P697.13 million.

“[Today] we might see a big of profit taking,” he said.

He placed the market’s technical resistance at 7,400, which if not met might see shares going back to the 7,200 to 7,300 level.

The PSE index fell 2.3% last week after the presidential elections weighed on sentiment.

“From an economic perspective, we feel that fears are overdone; Philippines will probably retain its status of bright spot in Asia while its investment grade status is unlikely to be impacted,” Mizuho Bank said in a note on Tuesday.

It is not clear when president-elect Mr. Duterte’s victory will be officially declared but he is expected to take office on June 30.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said other factors that pushed the market up include gains in global equities, the oil market and the weakness of the Japanese yen against the dollar.

“US stocks closed 1.25% higher with the Dow recording its best day since March,” he said.

“Major averages in Europe ended higher as well as sentiment was boosted by the recovery of commodity stocks and a number of positive earnings,” he said. “The Euro Stoxx 600 was up +0.9% with almost all sectors ending in the green.” — Victor V. Saulon with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-nears-7400-mark-as-election-jitters-subside&id=127326

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion