Top Ten Smart Money Moves – May 12, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 12, 2016 Data)

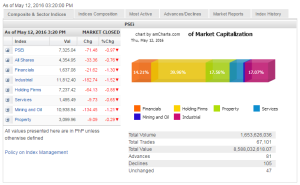

Total Traded Value – PhP 8.588 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 105 Declines vs 81 Advances = 1.30:1 Neutral

Total Foreign Buying – PhP 4.964 Billion

Total Foreign Selling – (Php 4.999) Billion

Net Foreign Buying (Selling) (Php 0.035) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

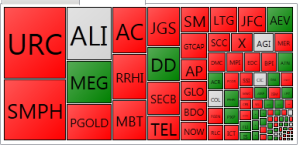

PSE Heat Map

Screenshot courtesy of: PSEGET Software

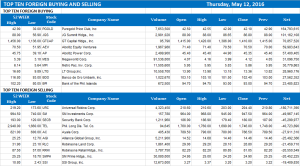

Top Ten Foreign Buying and Selling

and Selling

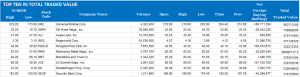

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 12, 2016 08:31:00 PM

PSEi retreats as investors pocket gains from rally

LOCAL SHARES retreated on Thursday following two straight days of upsurge after early election-related jitters were eased by what many analysts described as a peaceful and seemingly clean conduct of national polls.

The Philippine Stock Exchange index (PSEi) shed 71.48 points or 0.96% to close at 7,325.04.

The all-shares index gave up 33.36 points or 0.76% to end at 4,354.95.

“Asian markets opened lower today after US and European equities took a step down last night,” said Luis A. Limlingan, business development head at Regina Capital Development Corp.

“In the region, the Philippines continues to catch a post-election bid, and leading candidate [Rodrigo] Duterte draws up a list of gunslingers for his Cabinet,” he said.

He said “unsurprisingly,” vice-presidential candidate Ferdinand R. Marcos, Jr. was citing irregularities in the vote counting that had placed him in the second spot in the race for the second highest position in the land.

All sectoral indices finished lower, with industrials recording the biggest decline as it gave up 1.52% or 182.74 points to end at 11,812.40.

It was followed by financials, which lost 21.62 points or 1.30% to close the session at 1,637.08. Mining and oil dropped 134.45 points or 1.21% to end at 10,938.94; holding firms declined 64.13 points or 0.87% to 7,237.42; services slipped by 9.73 points or 0.64% to 1,495.49; and property gave up 9.09 points or 0.29% to 3,099.96.

Value turnover stood at P8.59 billion as 1.65 billion shares changed hands, down from Wednesday’s P12.86 billion.

Decliners outnumbered advancers, 105 to 81.

Net foreign selling amounted to P35.07 million yesterday, a turnaround from the previous session’s net buying worth P1.88 billion.

Universal Robina Corp., SM Prime Holdings, Inc., Ayala Land, Inc., Megaworld Corp. and Puregold Price Club, Inc. were the most active stocks yesterday.

The biggest gainers were United Paragon Mining Corp., Anglo Philippines Holdings Corp., Keppel Philippines Properties, Inc., and Acesite (Philippines) Hotel Corp. and Roxas and Co., Inc.

The top losers were ISM Communications Corp., Vivant Corp., Concrete Aggregates Corp., IRC Properties, Inc. and Makati Finance Corp.

Asian markets fell on Thursday, with MSCI’s broadest index of Asia-Pacific shares outside Japan down 0.3% after Wall Street suffered its worst day since February following downbeat quarterly retail reports.

The other day, the bellwether PSEi extended its post-election rally to soar close to 7,400 as the results of the May 9 national polls indicate a clear presidential winner in Mr. Duterte, with the closest contenders already conceding defeat.

Some analysts expected profit taking after the Philippine Stock Exchange index gained 221.64 points or 3.08% on Wednesday to close at 7,396.52. — VVS with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-retreats-as-investors-pocket-gains-from-rally&id=127424

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion