Top Ten Smart Money Moves – May 13, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 13, 2016 Data)

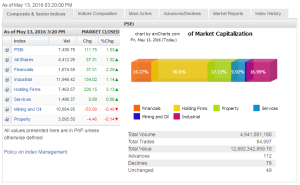

Total Traded Value – PhP 12.892 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 112 Advances vs. 78 Declines = 1.44:1 Neutral

Total Foreign Buying – PhP 6.984 Billion

Total Foreign Selling – (Php 6.316) Billion

Net Foreign Buying (Selling) Php 0.668 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

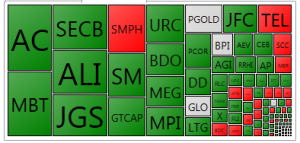

PSE Heat Map

Screenshot courtesy of: PSEGET Software

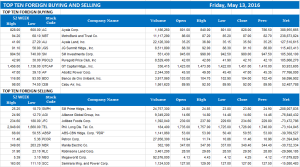

Top Ten Foreign Buying and Selling

and Selling

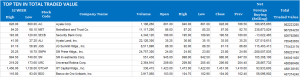

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 15, 2016 07:03:00 PM

Post-election bullishness to push stocks higher

THE STOCK market might mirror the pattern seen in 2010 when the country elected with a popular vote a president who promised to fight corruption, bring economic growth and attract foreign investments, analysts said.

“I feel like [Rodrigo R.] Duterte will kick off [the way same way as] PNoy [President Benigno S. C. Aquino III] when he started,” said Harry G. Liu, president of Summit Securities, Inc.

He said when Mr. Aquino assumed the presidency, the Philippine Stock Exchange index (PSEi) jumped from 3,600 and rose steadily to hit 8,300 to 8,400, before going down to 6,600. It has since stayed above that level.

“We may have a new high for next year, at least next year,” he said.

In the near term, confidence in local stocks has been building up, he said, adding that the main index’s rise could continue in the coming days.

“Am I bullish? Yes, from what I’ve heard as of today,” he said.

Week-on-week, the PSEi gained 444.92 points or 6.4% to close at 7,436.79 from 6,991.87 previously.

“We reached a resistance [on Friday] at 7,400 to 7,500 — that’s a big jump from the [previous] low. We went up almost 6%-plus on the whole picture for the week,” Mr. Liu said.

He said the recent performance of local shares was largely because of the investing public’s acceptance of the outcome of the elections. He added that even foreign investors took their cue from that and pushed stocks further up.

Miko A. Sayo, a trader at Angping & Associates Securities, Inc., shared that sentiment. “Foreign funds are starting to buy back into our market, so I think until they’ve exhausted all their buying the market is going to go higher,” he said. “I’m looking at 7,700 to 7,800… in the next couple of weeks.”

He said last year, foreign funds sold stocks worth about P50 billion, and “hardly bought anything this year.”

“You can just imagine just maybe if a third of that buys back into our market, it’s going to push our market higher… I guess they wanted to see the results of the election,” he said.

Last Friday, value turnover shot up to P12.89 billion from P8.59 billion last Thursday, as 4.94 billion shares changed hands.

Mr. Sayo said foreign investors will likely pour funds into the market then take a wait-and-see stance while the new administration fleshes out its policies. At some point, the index will stop its climb, he said.

Summit Securities’ Mr. Liu said in the next six months, the market will have to consolidate based on how the new president forms his economic team and Cabinet members.

“That’s what you call the political risk that is going to become positive if you get the right people, the right vision and continue… The downside is don’t deliver what you said then we’re going to get that negative downside,” Mr. Liu said, referring to Mr. Duterte’s promises during the campaign period. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=post-election-bullishness-to-push-stocks-higher&id=127488

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion