Top Ten Smart Money Moves – May 16, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 16, 2016 Data)

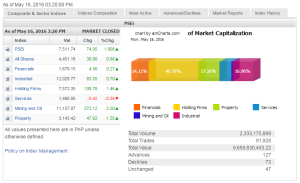

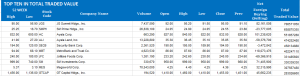

Total Traded Value – PhP 9.660 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 127 Advances vs. 73 Declines = 1.74:1 Neutral

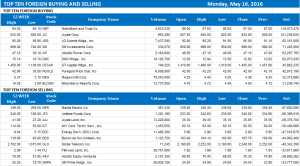

Total Foreign Buying – PhP 5.438 Billion

Total Foreign Selling – Php 5.165 Billion

Net Foreign Buying (Selling) Php 0.273 Billion – 2nd day of Net Foreign Buying after a day of Net Foreign

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

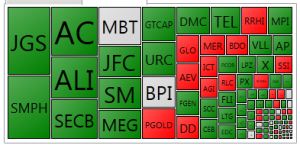

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 16, 2016 07:47:00 PM

Election euphoria propels PSEi past 7,500 mark

STOCKS maintained their trek upwards on Monday despite early expectations that they will close lower to follow the movement of the US market, which eased on Friday.

“We expected that today would be lower, but instead of doing that, we’re up but not a lot,” Joseph Y. Roxas, president of Eagle Equities, Inc., said on Monday.

“I guess this is still part of the euphoria after the elections,” he added.

The Philippine Stock Exchange index (PSEi) gained 74.95 points or 1% to close at 7,511.74 yesterday.

The all-shares index inched up 38.90 points or 0.88% to 4,451.16.

Sectoral indices finished higher except for services, which shed 5.42 points or 0.36% to end at 1,490.95.

Among the sectors, the mining and oil index was the biggest gainer at 272.12 points or 2.5% to 11,157.07. Property followed with an increase of 47.92 points or 1.54% to 3,143.42. Holding firms gained 108.78 points or 1.45% to 7,572.35.

Increases in the other sectors were more modest, with financials gaining 4.56 points or 0.27% to 1,679.15 and industrials rising by 83.35 points or 0.69% to 12,029.77.

“Every election, not just this one, there is a honeymoon period… with the new president,” Mr. Roxas said. “Usually the market rallies for at least two months.”

He said his outlook for the market is “quite bullish… maybe especially because going into the elections, expectations were not too optimistic about the economic plans… Actually, it appeared that there were no economic plans.”

But he said when Rodrigo R. Duterte, the presumptive president, came out with an eight-point agenda on Thursday, “then it was a pleasant surprise after all… and it’s really to leave things as they are with a little adjustment here and there.”

He added that he was not seeing any factor that could trip the market’s direction except a protest in the vice-presidential position, but he said this would affect the market too much.

Value turnover on Monday came in at P9.7 billion as 2.33 billion shares changed hands.

Advancers outnumbered decliners at 127 against 73, while 47 shares finished unchanged.

Net foreign buying dropped to P272.57 million yesterday from the P667.92 million seen last Friday.

Other Asian markets also rallied Monday following last week’s sharp losses, with Tokyo boosted by a report that Japan’s prime minister plans to delay a planned sales tax increase.

The Nikkei 225 closed 0.3% higher, with a weaker yen also providing support.

Among other Asian markets, Hong Kong ended up 0.8% in the afternoon and Sydney closed 0.6% higher while Seoul gained 0.1%.

The Shanghai composite index ended 0.8% higher. Central bank assurances that it would continue with policies to support growth overshadowed weekend figures showing more weakness in the economy. — V. V. Saulon with AFP

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=election-euphoria-propels-psei-past-7500-mark&id=127557

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion