Top Ten Smart Money Moves – May 3, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 3, 2016 Data)

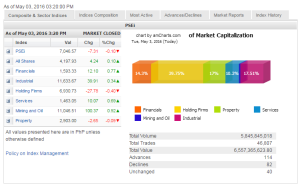

Total Traded Value – PhP 6.557 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 114 Advances vs. 82 Declines = 1.39:1 Neutral

Total Foreign Buying – PhP 4.194 Billion

Total Foreign Selling – (Php 4.163) Billion

Net Foreign Buying (Selling) Php 0.031 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

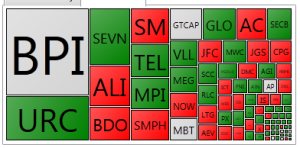

PSE Heat Map

Screenshot courtesy of: PSEGET Software

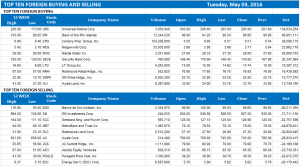

Top Ten Foreign Buying and Selling

and Selling

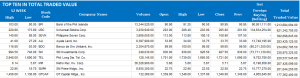

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 03, 2016 08:17:00 PM

Stocks fall further on China manufacturing data

LOCAL SHARES extended their decline to an eighth straight session as investors pocketed gains following dismal manufacturing data from China, analysts said.

Poll worries, Japan’s steady policy weigh furtherQ1 corporate earnings to dictate trading aheadTrading ‘quiet’ on poll campaign noiseSigns of recovery surface amid general weaknessSectoral indices retreat ahead of Fed, BoJ remarks

The benchmark Philippine Stock Exchange index (PSEi) slipped by 7.31 points or 0.10% to close at 7,046.57, although the broader all-shares index gained 4.24 points or 0.10% to settle at 4,197.93.

Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said investors avoided risky assets “due to disappointing manufacturing data from China.”

Reuters reported that the Caixin/Markit Manufacturing Purchasing Managers’ index dropped to 49.4 in April, lower than market expectations of 49.9 and recoiling from the previous month’s 49.7. The index has been below the 50-point neutral level which marks expansion in activity from contraction since March 2015, though the rate of decline has eased recently, raising hopes that the sector’s prolonged slump may be bottoming out.

“PSEi broke the short-term 7,180 resistance level which triggers investors to pocket their gains ahead of important nonfarm payrolls on Friday and election on Monday. Investors are looking for positive news, but they are not seeing any market-moving event, which pushed investors to sell off within the past 8 trading days already,” Ms. Telagen said in a mobile phone reply.

Arbee B. Lu, equity research analyst at BA Securities, Inc., said separately in an e-mail reply: “[Yesterday] we still ended in the red as investors were selective in their bargain hunting. While the index may be due for a technical rebound soon, bearish sentiment will likely dominate given that the soundness of Japan’s monetary policy and the direction of the elections remain under scrutiny.”

Two out of six domestic subindices ended in the red, with holding firms dropping 27.78 points or 0.39% to 6,930.73 and property shedding 2.65 points or 0.09% to 2,903.

In contrast, mining and oil surged by 100.37 points or 0.91% to 11,046.51; financials advanced by 12.10 points or 0.76% to 1,593.33; services advanced by 10.07 points or 0.69% to 1,463.05; and industrials inched up by 39.91 points or 0.34% to 11,633.67.

Tuesday’s busiest decliners were Ayala Land, Inc., BDO Unibank, Inc., SM Investments Corp. and SM Prime Holdings, Inc.

Value turnover improved to P6.56 billion after 5.85 billion shares changed hands, from the P5.10 billion seen on Monday.

Net foreign buying amounted to P30.31 million yesterday, a turnaround from the P26.49 million in net sales logged the previous session. Gainers outnumbered losers, 114 to 82, while 40 names did not move.

BA Securities’ Ms. Lu said that if upcoming corporate earnings releases mostly fall within consensus estimates, “it may at least temper market volatility and improve sentiment.”

“In the meantime, we look forward to flat market movements with slight downward bias.” — Daphne J. Magturo with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-fall-further-on-china-manufacturing-data&id=126947

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion