Top Ten Smart Money Moves – May 31, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 31, 2016 Data)

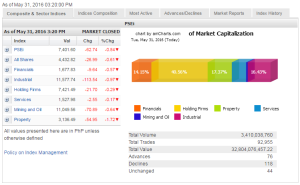

Total Traded Value – PhP 32.804 Billion – High

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 118 Declines vs. 76 Advances = 1.55:1 Neutral

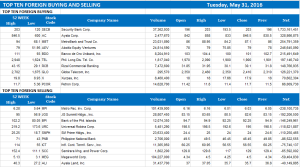

Total Foreign Buying – PhP 25.709 Billion

Total Foreign Selling – (Php 23.400) Billion

Net Foreign Buying (Selling) Php 2.309 Billion – 5th day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

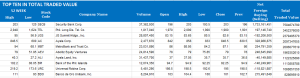

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 31, 2016 07:44:00 PM

PSEi takes hit from month-end window dressing

THE PHILIPPINE Stock Exchange index (PSEi) on Tuesday shed 62.74 points or 0.84% to end the month at 7,401.60 as investors pocketed their gains after the market’s recent rally, analysts said.

“Markets sold down to take profit for the month-end window-dressing as the index closed up 4.4% for May,” said Luis A. Limlingan, business development head at Regina Capital Development Corp., referring to the main index’s performance against the end-April level.

All sectoral indices finished lower, with property registering the biggest drop at 54.95 points or 1.72% to 3,136.49, followed by industrials, which slipped by 113.54 points or 0.97% to 11,577.74.

Mining and oil dipped by 70.89 points or 0.63% to 11,049.56; financials shed 9.64 points or 0.57% to 1,677.83; holding firms dropped 21.70 points or 0.29% to 7,421.49; while services posted the smallest decline at 2.55 points or 0.16% to 1,527.98.

Joylin F. Telagen, research head at IB Gimenez Securities, said investors cashed their gains in Universal Robina Corp. (URC) and JG Summit Holdings, Inc. after URC lowered its revenue expectations to 6%-7% from the original 8%-9% because of tough market conditions.

She added that yesterday’s decline was also due to a “risk-off sentiment” after the comment by US central bank chief Janet Yellen that an interest rate increase was appropriately probable in the coming months.

Still, she said the market was still “data dependent” and that investors might be looking at these ahead of the next Federal Reserve meeting.

Regina Capital’s Mr. Limlingan said investors switched their focus to regional and local news as the US was still on a holiday and markets there were shut.

“Fund managers decided to take some money off the table given the recent rally, and that the macroeconomic picture in the US seems rosier than in Asia,” he said.

Total value of trades yesterday was at P32.80 billion, up from P15.39 billion the other day, on around 3.41 billion shares that changed hands. Decliners outnumbered advancers, 118 to 76, while 44 issues were unchanged.

Net foreign buying surged to P2.31 billion from Monday’s P469.67 million.

“Many issues also changed towards closing as the MSCI rebalanced its portfolio for its quarterly appraisal,” Mr. Limlingan said, referring to the review of the research-based index provider.

“MSCI rebalancing added to market transactions but more positive on actively traded stock SECB (Security Bank Corp.) as the company moves to mid-cap to small cap,” Ms. Telagen said.

Southeast Asian stocks were largely cautious on Tuesday, as investors waited for cues from US inflation and employment data next week, the two most important indicators for a data-dependent US Federal Reserve.

Investors will also be keeping a keen eye out for Ms. Yellen’s speech in Philadelphia for clarity the rate movement. — Victor V. Saulon with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-takes-hit-from-month-end-window-dressing&id=128330

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion