Top Ten Smart Money Moves – May 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 4, 2016 Data)

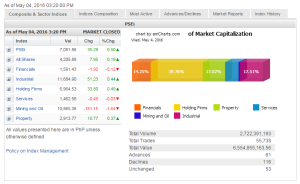

Total Traded Value – PhP 6.555 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 116 Declines vs. 61 Advances = 1.90:1 Neutral

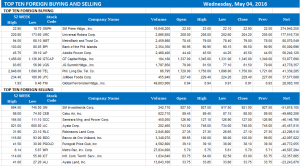

Total Foreign Buying – PhP 3.539 Billion

Total Foreign Selling – (Php 3.096) Billion

Net Foreign Buying (Selling) Php 0.443 Billion – 2nd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

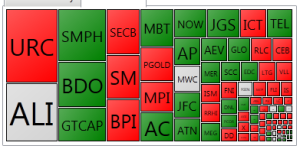

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

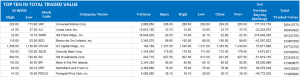

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 04, 2016 08:26:00 PM

Stocks eke out modest gains on bargain hunting

SHARES closed slightly higher on Wednesday after an eight-day losing streak as investors picked up cheap stocks while staying on the sidelines just a few days before the national elections.

Stocks fall further on China manufacturing dataPoll worries, Japan’s steady policy weigh furtherQ1 corporate earnings to dictate trading aheadTrading ‘quiet’ on poll campaign noiseSigns of recovery surface amid general weakness

The bellwether Philippine Stock Exchange index (PSEi) rebounded at 35.29 points or 0.50% to settle at 7,081.86, while the broader all-shares index gained 7.95 points or 0.18% to close at 4,205.88.

Alexander Adrian O. Tiu, research analyst at AB Capital Securities, Inc., said in a phone interview: “The market’s rebound was mainly due to bargain hunting. Since investors find the market cheaper as of the moment, the normal thing for them to do is to buy more stocks thus increasing the market.”

“Corporate earnings for the first quarter are also on the sidelines due to uncertainties with the upcoming elections,” added Mr. Tiu.

Lexter L. Azurin, head of research at Unicapital Securities, Inc., said separately by phone: “The rebound in the market was caused by last minute buyings on selected stocks.”

“JG Summit Holdings Inc., SM Prime Holdings, Inc. and PLDT, Inc. were the main contributors who accounted for the market increase,” Mr. Azurin said.

Subindices were mixed, as three inched higher while the others declined.

Leading advancers was the holding firms counter, which gained 33.80 points or 0.48% to 6,964.53. Industrial rose by 51.23 points or 0.44% to 11,684.90; and property increased 10.77 points or 0.37% to close Wednesday’s trading at 2,913.77.

In contrast, mining and oil gave up 181.15 points or 1.64% to finish at 10,865.36, leading losers. Financials shed 1.90 points or 0.11% to close at 1,591.43; and services fell by 0.49 point or 0.03% to end at 1,462.56.

Value turnover was almost flat, ending at P6.55 billion after 2.72 billion shares changed hands, from Tuesday’s P6.56 billion.

Net foreign buying amounted to P443.45 million yesterday, surging from the P30.31 million seen on Tuesday.

AB Capital Securities’ Mr. Tiu said: “We might see a continuous rebound for the rest of the week primarily due to the elections.”

“We will be able to see range trading for the next few days as we approach May 9,” Unicapital Securities’ Mr. Azurin said.

REGIONAL STOCKS DOWN

Most Southeast Asian stock markets also fell on Wednesday on renewed global growth concerns, while Indonesian shares extended their losses after data showed the country’s economy grew at a slower-than-expected pace in the first quarter.

Singapore’s stock index fell 1.6% as shares of Singapore Telecommunications Ltd. and Oversea-Chinese Banking Corp. Ltd. extended losses.

Indonesia’s Jakarta Composite Index fell 0.9% after the Indonesian statistics agency reported first-quarter growth of 4.92%.

Bucking the trend, Malaysian shares rose 0.1%. — Tanya Mae B. Umali with Reuters Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-eke-out-modest-gains-on-bargain-hunting&id=127006

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion