Top Ten Smart Money Moves – May 5, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 5, 2016 Data)

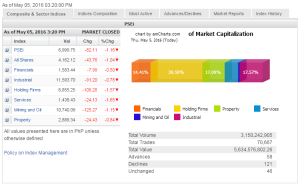

Total Traded Value – PhP 5.635 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 121 Declines vs. 58 Advances = 2.09:1 Bearish

Total Foreign Buying – PhP 3.143 Billion

Total Foreign Selling – (Php 3.759) Billion

Net Foreign Buying (Selling) (Php 0.616) Billion – 1st day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

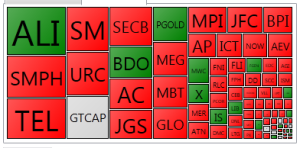

PSE Heat Map

Screenshot courtesy of: PSEGET Software

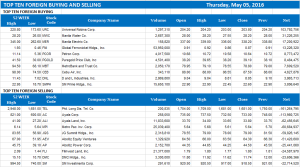

Top Ten Foreign Buying and Selling

and Selling

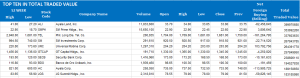

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 05, 2016 08:48:00 PM

Index falls below 7,000 mark on election jitters

AFTER a day’s respite, stocks resumed their slide on Thursday on external factors ahead of the long weekend in view of the elections on Monday that might keep traders jittery until poll-related uncertainties settle.

The bellwether Philippine Stock Exchange index fell below the 7,000 mark as it lost 82.11 points or 1.15% to close at 6,999.75. The broader all-shares index gave up 43.76 points or 1.04% to end at 4,162.12.

“The next few days, it will probably go down but it’s not because of any particular candidate… People are just going to go short because they’re going to wait for the election,” Eduardo V. Francisco, president of BDO Capital and Investment Corp.’s investment banking group, said in a chance interview.

“When there is a long holiday, the fund managers usually reduce their position,” he added. “Here it’s not only long holiday, it’s also elections. So a lot of things could happen.”

All six sectoral indices fell, with services posting the deepest fall at 24.13 points or 1.65% to 1,438.43. Holding firms lost 109.28 points or 1.56% to 6,855.25. Mining and oil shed 125.27 points or 1.15% to 10,740.09. Property also lost 24.43 points or 0.83% to 2,889.34. Industrials dipped 91.20 points or 0.78% to 11,593.70, while financials eased by 7.99 points or 0.50% to 1,583.44.

Value turnover dropped to P5.63 billion as 3.15 billion shares changed hands, from Wednesday’s P6.55 billion.

Decliners trumped advancers, 121 to 58, while 46 stocks were flat.

Foreigners turn sellers, with net outflows logged at P616.05 million, a reversal of Wednesday’s net buying worth P443.45 million.

“Investors could be shying away from the market given the concerns still on some data coming from the US pointing to a slowdown in its economic growth,” Astro C. del Castillo, managing director at First Grade Finance, Inc. said, adding that to some extent concerns about China’s growth was also a factor. “But last night it’s more on the US because of the jobs data,” he said on Thursday.

Mr. del Castillo also pointed to the first-quarter income reports of some companies that were below expectations, including Philippine Long Distance Telephone Co., which on Thursday fell 3.94% to close at P1,681 per share.

He added that the effect of election concerns was secondary to the market’s slump during the day.

“With all these noise, they [fund managers] will probably stay safe and probably move to cash,” BDO Capital’s Mr. Francisco said. “After the elections, regardless of who wins as long as it’s announced, then the market will go back up.”

He added that generally, the market moves up immediately after elections.

“What will spook the market is if candidate X and Y are so close,” he said.

He added that if there are complaints and accusations of cheating after the polls, the market might be affected.

“Then we can’t go back to business,” Mr. Francisco said. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=index-falls-below-7000-mark-on-election-jitters&id=127097

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion