Top Ten Smart Money Moves – October 10, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

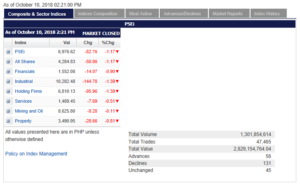

Total Traded Value – PhP 5.370 Billion – Low

Advances Declines – (Ideal is 2:1) 139 Declines vs. 54 Advances = 2.57:1 Bearish

Total Foreign Buying PhP 2.557 Billion

Total Foreign Selling – (PhP 3.065) Billion

Net Foreign Buying (Selling) – (PhP 0.508) Billion – 30th day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

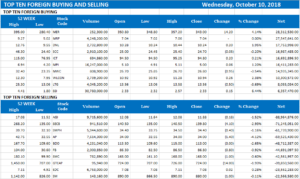

Top Ten Foreign Buying and Selling

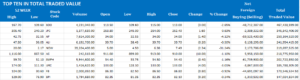

Top Ten in Total Traded Value

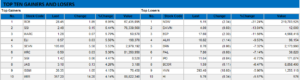

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Local stocks slump as PHL growth prospects dim

October 10, 2018 | 9:00 pm

By Arra B. Francia, Reporter

THE MAIN INDEX weakened anew on Wednesday, nearing its record low for the year as the sluggish outlook on the country prompted more foreign investors to pull out their funds from the local market.

The benchmark Philippine Stock Exchange index (PSEi) plunged 0.82% or 58.24 points to close at 7,001.14 yesterday, managing to bounce back from an intraday low of 6,960.43, just a few points shy of its 52-week low of 6,923.67.

The broader all-shares index also slumped 0.85% or 36.95 points to 4,298.74.

“The PSEi ended negative today as worries on global growth keep market sentiment pessimistic. The IMF’s sluggish outlook for the Philippine economy is one of the reason why investors, especially the foreigners, are still selling their shares,” Timson Securities, Inc. Equities trader Jervin S. de Celis said in a mobile message on Wednesday.

The International Monetary Fund (IMF) recently lowered its growth forecast for the Philippines to 6.5% from its previous projection of 6.7%, citing downside risks such as “rising inflation, continued rapid credit growth, higher US interest rates and US dollar, volatile capital flows, and trade tensions.”

Aside from the IMF, the World Bank also cut its growth forecast on the country to 6.5%, from the previous 6.7% forecast.

“Since we lack fresh leads to buoy the local market sentiment, market participants are either staying on the sidelines or they trade select second-liner stocks that have been rallying,” Mr. De Celis added.

Papa Securities Corp. trader Gabriel Jose F. Perez noted the day’s net foreign selling figure of P507.96 million once again pulled down the market, which swelled from Tuesday’s P158.01-million net outflow.

“With the index teetering and closing right on the 7,000 psychological level and also just a few points above its previous 2018 intraday low of 6,923, we should watch out if foreign selling once again proves to be the index’s bane tomorrow,” Mr. Perez said in an e-mail.

The bloodbath spilled over to the sectoral indices, led by financials which fell 0.98% or 15.44 points to 1,550.71.

Holding firms followed, declining 0.87% or 60.33 points to 6,845.76. Property shed 0.63% or 22.29 points to 3,497.32; industrials dropped 0.62% or 64.88 points to 10,362.38; services slipped 0.52% or 7.84 points to 1,489.30; while mining and oil dipped 0.14% or 12.66 points to 8,622.42.

Some 1.53 billion issues valued at P5.37 billion switched hands, climbing from the previous session’s P4-billion turnover.

Decliners outpaced advancers, 139 to 54, while 50 names ended flat.

“I think the 3Q GDP (gross domestic product) growth and corporate profit reports can improve market sentiment if they turn out better when they are released next month,” Timson Securities’ Mr. De Celis said.

Source: https://www.bworldonline.com/local-stocks-slump-as-phl-growth-prospects-dim/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.