Top Ten Smart Money Moves – October 12, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on October 12, 2016 Data)

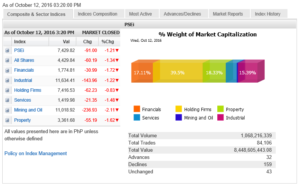

Total Traded Value – PhP 8.449 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 159 Declines vs. 32 Advances = 4.97:1 Bearish

Total Foreign Buying – PhP 4.687 Billion

Total Foreign Selling – (PhP 5.243) Billion

Net Foreign Buying (Selling) – (PhP 0.556) Billion – 6th day of Net Foreign Selling after 4 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

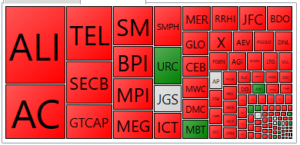

PSE HEAT MAP

Screenshot courtesy of PSEGET

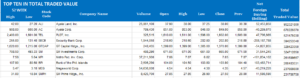

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece: ==================================================

Stocks decline on Wall Street sell-off, oil slump

Posted on October 13, 2016

LOCAL STOCKS fell yesterday, weighed down by Wall Street following weak earnings reports in the United States and amid other external concerns.

The Philippine Stock Exchange index (PSEi) dove 91 points yesterday or 1.21% to 7,429.82, while the broader all-shares fell 60.19 points or 1.34% to 4,429.84.

“The earning season in the states get tough traditionally. I think it’s because of the weak earnings as well as the anonymous signs of things to come for the States,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said in a phone interview yesterday.

Reuters reported a sell-off in Wall Street as disappointing corporate reports gave a sour tone to the start of earnings season and investors digested possible changing dynamics for the upcoming US elections.

“I think sovereign yields and weaker crude prices intensified the sell-off today (Wednesday),” Mr. Limlingan added.

For her part, COL Financial Group, Inc. Vice-President and Head of Research April Lynn C. Lee-Tan said that a break of 7,493 “would drive prices lower finding support between 7,330-7,268 as a first target.”

In a commentary on whether or not President Rodrigo R. Duterte should be blamed for the weak financial markets, she said: “Admittedly, negative investor sentiment could lead to the continuous sell-off of the stock market and the peso, although at present, the growing concerns of a December Fed rate hike and the tapering of the ECB’s (European Central Bank) bond purchases are also negatively affecting equity markets and currencies globally.”

“However, we still believe that the ongoing sell-off is an opportunity to invest in the market at cheaper valuations. At this point, the damage caused by the President’s negative comments is not beyond repair.”

“We are quite hopeful that the president will tone down his rhetoric if his trust rating drops significantly and if his economic managers inform him that economic growth is being hurt by his statements.”

All sub-indices fell yesterday, with mining and oil taking the biggest decline, losing 236.93 points or 2.1% to 11,018.92. Services lost 21.35 points or 1.48% to 1,419.98; property decreased 55.19 points or 1.62% to 3,361.68; holding firms skidded 62.23 points or 0.83% to 7,416.53; industrials shed off 143.96 points or 1.22% to 11,634.41, while financials slid 30.99 points or 1.72% to 1,774.81

Value turnover rose to P8.45 billion after 1.07 billion shares changed hands from P7.17 billion on Tuesday. There were 159 decliners, 32 advancers, while 43 names remained flat.

Net foreign selling slid to P555.95 million from P588.05 million on Tuesday.

Most Southeast Asian stock markets also fell on Wednesday, tracking Asian peers, on subdued risk sentiment as expectations the US Federal Reserve would hike interest rates in December lifted the dollar and pushed up bond yields overnight. — R.S.C. Canivel with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-decline-on-wall-street-sell-off-oil-slump&id=134758

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion