Top Ten Smart Money Moves – October 14, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on October 14, 2016 Data)

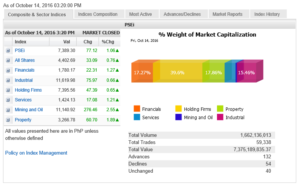

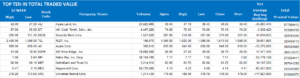

Total Traded Value – PhP 7.375 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 132 Advances vs. 54 Declines = 2.44:1 Bullish

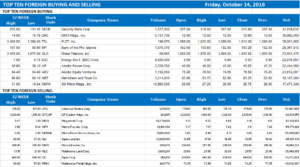

Total Foreign Buying – PhP 4.237 Billion

Total Foreign Selling – (PhP 4.655) Billion

Net Foreign Buying (Selling) – (PhP 0.418) Billion – 8th day of Net Foreign Selling after 4 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

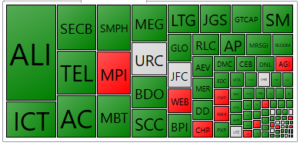

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece: ==================================================

Local stocks end the week in the green

Posted on October 15, 2016

By Roy Stephen C. Canivel, Reporter

THE local stock market ended the week in positive territory, which analysts attributed to a technical bounce.

The Philippine Stock Exchange index (PSEi) on Friday closed 77.12 points or 1.05% higher at 7,389.30, while the broader all-shares climbed 33.09 points or 0.75% to 4,402.69.

“I think today is a technical rebound. It’s some buying relief and a bit of bargain hunting. Even though we had net foreign selling of over P400 million, we were still able to end up which suggests that local investors propped up the market and a lot of investors took the 7,300 level as the new strong support,” Victor F. Felix, analyst with AB Capital Securities, said in a phone interview.

“If we ended lower again by 1%, like the past few days, that would be a very bearish signal.”

Mr. Felix said that investors are trying to avoid three straight days of decline.

“On Fridays, we wouldn’t see this big of a gain, considering it is end of the week and not a lot of investors would want to have an open position towards the weekend for fear of black swan events or unexpected bad news. But this Friday, we saw a 1% gain so again it points to bargain hunting and technical rebound.”

Citing more factors that point to a gain due to technicals, he mentioned the awaited speech of Federal Reserve chair Janet Yellen scheduled on Friday night, which investors are hoping to find clues on the likelihood of a U.S. rate hike in December.

“Tonight, there is the speech of Janet Yellen. Usually investors would be on a risk off ahead of the speech to get more signals but they weren’t. Again this suggests technical rebound and bargain hunting,” Mr. Felix said.

Regina Capital Development Corp. Managing Director Luis A. Limlingan shared this opinion.

“It was a technical bounce today given two huge drops from the previous day. Well, jobless gains were unchanged in the States and the imports were modest too. So no immediate cause for concern but we see this as more of a technical bounce from the 7,350 support level,” he said in a phone interview.

All subindices rose on Friday, with mining and oil taking the lead, increasing 276.46 points or 2.55% to 11,140.92.

Industrials climbed 75.97 points or 0.66% to 11,619.98; property added 60.7 points or 1.89% to 3,266.78; holding firms increased 47.39 points or 0.64% to 7,395.56; financials added 22.31 points or 1.27% to 1,780.17; services improved 17.08 points or 1.21% to 1,424.13.

Value turnover fell to P7.38 billion from P8.78 billion on Thursday.

There were 132 advancers, 54 losers, and 40 were flat.

Net foreign selling eased to P418.44 million from P748.09 million on October 13.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=local-stocks-end-the-week-in-the-green&id=134917

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion