Top Ten Smart Money Moves – October 19, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

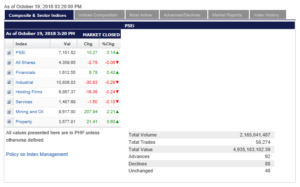

Advances Declines – (Ideal is 2:1) 92 Advances vs. 88 Declines = 1.05:1 Neutral

Total Foreign Buying PhP 2.864 Billion

Total Foreign Selling – (PhP 3.085 Billion

Net Foreign Buying (Selling) – (PhP 0.221) Billion – 37th day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

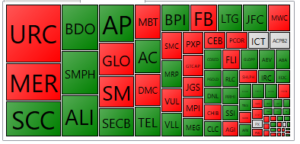

PSE HEAT MAP

Screenshot courtesy of PSEGET

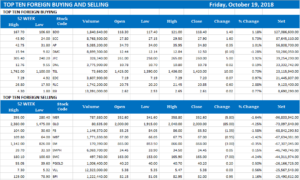

Top Ten Foreign Buying and Selling

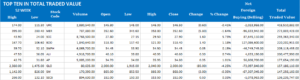

Top Ten in Total Traded Value

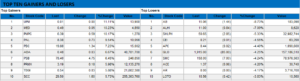

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Shares may move sideways ahead of Q3 earnings

October 22, 2018 | 12:01 am

By Arra B. Francia, Reporter

SHARES may continue moving sideways in the week ahead as investors look forward to the release of third quarter earnings reports.

The 30-company Philippine Stock Exchange index (PSEi) went up 0.14% to close at 7,151.52 last Friday, pushing the main index 2.1% higher on a weekly basis. The index was lifted by the mining and oil counter, which soared 9.6% last week, alongside financials that jumped 4.04%.

Daily turnover slimmed to P4.8 billion, seven percent lower from the previous week, while net foreign selling weakened by 29% to P393 million on average.

“With the first tranche of nine-month earnings, attention should firm up how corporates are strategizing on challenges of rising borrowing costs, and whether expansion plans are still soldiered on,” online brokerage 2TradeAsia.com said in a weekly market note.

Eagle Equities, Inc. Research Head Christopher John Mangun noted the same, saying that should earnings reports exceed expectations, this could be the catalyst the market is waiting for to start going up again.

“For [this] week, the market can trade sideways and shuffle around the 7,000-level or investors may come in and bargain hunt as there are several companies that have been taking a constant beating in the last few months,” Mr. Mangun said in a market report.

The analyst also flagged the constant foreign selling in the market, which will continue to drag the PSEi’s performance. As of Friday, the PSEi has already seen 37 consecutive days of net foreign outflows.

On the other hand, the appreciation of the Philippine peso last week could also uplift sentiments moving forward.

“The influx of OFW remittances in the fourth quarter may strengthen the currency further and may calm yet another concern of investors,” Mr. Mangun said.

Meanwhile, 2TradeAsia.com noted the general sentiment in markets overseas. Wall Street suffered losses in the previous weeks, due to a combination of geo-political tensions between the United States and Saudi Arabia, the US with China, and rising interest rates. This weakness has likewise dampened sentiment in Asian markets, including the Philippines.

“Most however, will have to come to terms on hints of rate tightening from the [US Federal Reserve], as this carries a weight in capital flows,” 2TradeAsia.com said.

Locally, the online brokerage said the upcoming midterm elections could turn into “market-movers” for the end of 2018.

“During an election year, it is worth to note: local consumption (a major dynamo to national output) generally outperforms; and market-friendly policies can be expected to deepen support from the electorate,” 2TradeAsia.com explained.

Eagle Equities’ Mr. Mangun placed the PSEi’s support from 7,000 to as low as 6,800, with resistance to reach 7,200 to 7,500.

Source: https://www.bworldonline.com/shares-may-move-sideways-ahead-of-q3-earnings/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.