Top Ten Smart Money Moves – October 23, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on October 23, 2017 Data)

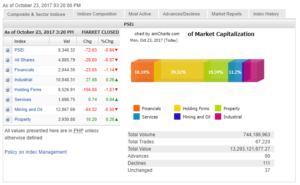

Total Traded Value – PhP 13.293 Billion – Medium

Advances Declines – (Ideal is 2:1) 111 Declines vs. 90 Advances = 1.23:1 Neutral

Total Foreign Buying – PhP 10.339 Billion

Total Foreign Selling – (PhP 2.772) Billion

Net Foreign Buying (Selling) – PhP 7.567 Billion – first day of Net Foreign Buying after 3 days of Net Foreign Selling (PhP7.487 from Block Sale of Ayala Corp.)

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

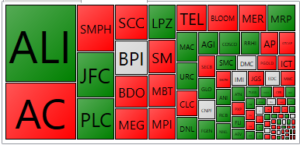

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

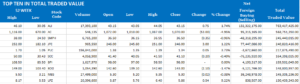

Top Ten in Total Traded Value

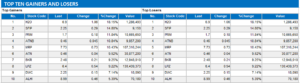

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Bourse weakens further as correction continues

October 24, 2017

LOCAL EQUITIES weakened further on Monday as investors continued taking profit in the wake of last week’s record highs and ahead of third-quarter earnings reports.

The Philippine Stock Exchange index (PSEi) shed 72.63 points or 0.86% to end 8,348.32 yesterday — the lowest level in two weeks, while the broader all-shares index likewise declined by 28 points or 0.57% to 4,885.79.

“Philippine equities continued on profit taking after hitting a new record high last week, and remained on the sidelines prior to the release of earnings,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said in a mobile phone message.

RCBC Securities, Inc. equity research analyst Jeffrey Lucero noted Monday’s low value turnover, attributing the market performance yesterday to “profit taking still, but investors may have stayed on the sidelines ahead of reporting season as total value turnover (not including block sales) was feeble at P5.4 billion.”

Much of Asia saw mixed fortunes despite Wall Street’s record highs last week, with Japan’s Nikkei Stock Average 225 and TOPIX index, South Korea’s KOSPI, the Shanghai-Shenzhen CSI 300 and the Jakarta Composite index rising 1.11%, 0.84%, 0.02%, 0.10% and 0.53%, respectively, while Hong Kong’s Hang Seng, the S&P/ASX 200 and the MSCI AC Asia Pacific gave up 0.64%, 0.22%, and 0.10%.

Unlike Friday, which saw all six Philippine sectoral indices end lower, Monday saw the sectors equally divided between those that gained and those that lost.

Holding firms led the drop, falling by 156.88 points or 1.8% to finish 8,526.91, followed by financials that gave up 23.55 points or 1.13% to 2,044.35 as well as mining and oil that declined by 64.32 points or 0.49% to end 12,867.69.

RCBC Securities’ Mr. Lucero noted that holding firms Ayala Corp. and SM Investments Corp. “which practically drove the run-up of the PSEi the previous weeks fell heavily today” giving up 4.95% to P1,017 and 3.01% to P950 apiece, respectively.

The other three sectoral indices ended with gains: property added 10.20 points or 0.26% to 3,930.88, industrials increased by 27.68 points or 0.25% to 10,848.31, while services rose by 0.74 of a point or 0.04% to 1,698.75.

Stocks that gained were led by Melco Resorts and Entertainment (Philippines) Corp., Lopez Holdings Corp., and Premium Leisure Corp. that surged by 10.43% to P7.73, 9.22% to P6.40, and 3.73% to P1.39 apiece, respectively.

A total of 744.19 million issues worth P13.29 billion changed hands, compared to Friday’s 906.29 million shares worth P10.17 billion. Stocks that lost edged out those that gained 111 to 90, while 37 were unchanged.

Monday capped three straight trading days of net foreign selling, recording P7.57-billion net buying this time. — Arra B. Francia

Source: http://bworldonline.com/bourse-weakens-correction-continues/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book continues to receive positive response and comments from our readers. To reach a wider audience we have made the book available through selected branches of National Bookstore:

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.