Top Ten Smart Money Moves – September 30, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on September 30, 2016 Data)

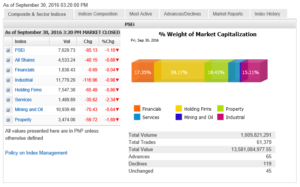

Total Traded Value – PhP 13.581 Billion – Medium (PhP 4.384 Billion attributed to URC Block Sales)

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 119 Declines vs. 65 Advances = 1.83:1 Neutral

Total Foreign Buying – PhP 9.828 Billion

Total Foreign Selling – (PhP 5.971) Billion

Net Foreign Buying (Selling) PhP 3.857 Billion – 2nd day of Net Foreign Buying after 25 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

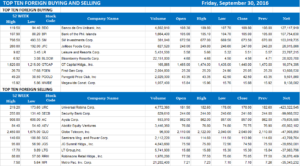

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

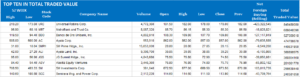

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece: ==================================================

Stocks to move sideways as uncertainties linger

By Keith Richard D. Mariano, Reporter

Posted on October 03, 2016

LOCAL STOCKS may trade sideways this week, with the main index likely hovering around the 7,600 level, amid questions surrounding the financial condition of banking giants abroad as well as economic and political developments at home.

“Gauges might trend sideways for now, possibly with downward bias on any intraday ascents, unless Friday’s net foreign buying is sustained this week,” 2TradeAsia.com said in a weekly outlook.

The Philippine Stock Exchange index (PSEi), for instance, may test the 7,500 level as immediate support and the 7,700 mark as resistance after ending 93.87 points or 1.22% lower at 7,629.73 last week, it said.

The bellwether last week reflected investors’ cautiousness ahead of the Sept. 26-28 meeting of the Organization of the Petroleum Exporting Countries in Algiers. The group would later reach an understanding to slash their production to boost oil prices.

On Friday, the PSEi plunged along with peers in the region and the United States on concerns over the financial condition of German banking giant Deutsche Bank AG as well as Wells Fargo & Co.

“Part of the limelight was shifted to the US Presidential debate, apart from local political headlines,” 2TradeAsia.com noted.

Still, whether global markets could isolate issues surrounding Deutsche Bank’s legal controversy that could prod the bank to raise extra capital apart from allegations of fake-account scandal in Wells Fargo remains unknown, 2TradeAsia.com said.

“While these may create a bearing on sentiment, assurances from the local central bank would help assuage fears of financial fallouts, since policies that have been put into force remain sound.”

In addition, 2TradeAsia.com cited downside risks coming from any indication the US Federal Reserve would hike interest rates by yearend, with the September jobs data scheduled for release this week.

Regina Capital Development Corp. Managing Director Luis A. Limlingan also expects the PSEi to trade sideways between 7,530/7,500 and 7,790.

A breach of either lines may trigger a major reversal, Mr. Limlingan said.

Aside from uncertainties coming abroad, Philippine equities are exposed to possible sentiment-shifts driven by local developments, the analysts noted.

“The highlight might still be locked on the peso’s weakness, plus indications on yields on the Bureau of Treasury’s upcoming placements in light of the administration’s resolve to pump-up infra spending,” 2TradeAsia.com said.

“Sequels to the House probe on alleged NBP (New Bilibid Prison) drug trade and extra judicial killings will be monitored, in time for some fund managers’ fourth-quarter seasonal window-dressing,” the brokerage added.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-to-move-sideways-as-uncertainties-linger&id=134235

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion