Top Ten Smart Money Moves – September 7, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on September 7, 2017 Data)

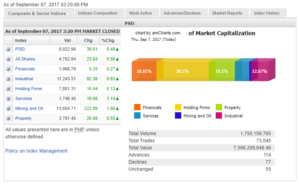

Total Traded Value – PhP 7.566 Billion – Low

Advances Declines – (Ideal is 2:1) 114 Advances vs. 77 Declines = 1.48:1 Neutral

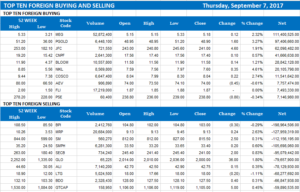

Total Foreign Buying – PhP 3.626 Billion

Total Foreign Selling – (PhP 4.522) Billion

Net Foreign Buying (Selling) –(PhP 0.896) Billion – 3rd day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

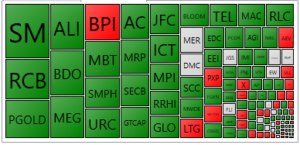

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

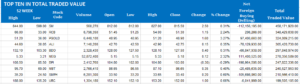

Top Ten in Total Traded Value

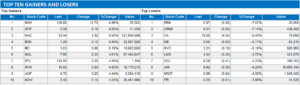

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Shares climb as Trump backs debt ceiling deal

September 8, 2017

DESPITE ongoing geopolitical tensions in East Asia, the Philippine Stock Exchange index (PSEi) climbed slightly yesterday to return to the 8,000 level as investors viewed positively the US government’s proposal to raise its debt ceiling, easing worries over the possibility of a government shutdown.

The bellwether PSEi went up by 39.01 points or 0.48% to close at 8,022.98 on Thursday.

The all-shares index also climbed 23.63 points or 0.49% to 4,762.84.

“Philippine equities rebounded in line with Wall Street’s recovery rally as investors shook off concerns over North Korea’s arms buildup for the time being,” read the market recap of RCBC Securities, Inc.

Wall Street climbed on Wednesday, helped by news of an agreement to extend the debt limit, as stocks bounced back from a day-earlier selloff.

The Dow Jones Industrial Average rose 54.33 points or 0.25% to 21,807.64; the S&P 500 gained 7.69 points or 0.31% to 2,465.54; and the Nasdaq Composite added 17.74 points or 0.28% to 6,393.31.

“Philippine stocks edged higher along with the US after congressional leaders and President Donald Trump agreed to extend the debt limit deadline and fund the government through mid-December,” Luis A. Limlingan, Regina Capital Development Corp. managing director, said via text.

Mr. Trump, siding with Democrats over his fellow Republicans, said he agreed to pass an extension of the US debt limit until Dec. 15, potentially avoiding an unprecedented default on US government debt.

All sector sub-indices ended in the green, with mining and oil taking the lead as it rose 222.89 points or 1.65% to 13,654.71. Services added 19.66 points or 1.13% to 1,746.4; industrials increased by 92.36 points or 0.82% to 11,243.31; property rose 20.68 points or 0.55% to 3,781.45; financials went up 5.25 points or 0.26% to 1,968.76; and holding firms climbed 10.44 points or 0.13% to 7,881.31.

AB Capital Securities, Inc. senior equity analyst Lexter L. Azurin said the market “reached a significant volume,” with the index reflecting the performance of the US markets.

Trading value went up to P7.57 billion from Wednesday’s P6.72 billion, with 1.75 billion worth of shares changing hands.

Gainers beat losers, 114 to 77, while 55 names closed unchanged. Foreigners sold more shares, leading to a net selling of P896.45 million, higher than Wednesday’s P315.63 million.

Mr. Azurin said he expects trading in the next few sessions to stay within range. “I think the market might trade sideways for the next few days given that we don’t expect any major surprise or catalysts that make significant moves, so I think that’s what the markets [are] waiting [for].”

Philstocks.ph senior analyst Justino B. Calaycay, Jr. said in a phone call that amid the lack of fresh inputs in the market, there will be “tough bargain hunting” while “looking closely at North Korea.” — Anna Gabriela A. Mogato with Reuters

Source: http://bworldonline.com/shares-climb-trump-backs-debt-ceiling-deal/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book continues to receive positive response and comments from our readers. To reach a wider audience we have made the book available through selected branches of National Bookstore:

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.