Victims of Hype – Part 3 – From Victims to Victors

VOH – Victims of Hype – Part 3 – From Victims to Victors

Now that we understand the Hype Cycle we are in a better position to address the problem. As we previously stated we prefer to fix the problem rather than point the blame. Pointing the blame to the Hypers would just be making the apparent obvious. Pointing the blame to the Victims would just be adding insult to injury.

You fix a problem either by addressing the effects or addressing the cause. In this article we will try our best to do both.

Let us first address the effects. We are assuming that the victims have gone ALL-IN because of the hype. As a result they have either lost their trading capital or all of it have been stuck. We just hope that none of the victims are in a similar situation like the one we read in one of the Facebook posts – on the verge of contemplating suicide as a result. For those who have lost their trading capital, there is no other way except to replenish it again.

For those whose trading capital are stuck, they may want to consider taking portion of the loss depending on their loss tolerance, so that they will be able to trade again. Our trading capital is our primary means for conducting our trades and without it, no matter how good we have become as a result of the experience, we won’t be able to trade again.

Let us now address the cause, to avoid becoming victims again. Based on my experience, the main cause is MISGUIDED TRADING. In Part 1 of this article we have already given some advice to avoid becoming a victim. In addition, we give the following suggestions:

- Go back to basics. A basic knowledge of Technical Analysis – Trendlines, Support and Resistance are very necessary in order to be able to trade. We have shared free stock trading lesson videos in our Youtube Channel and tried to simplify the course Master’s Certificate in Technical Analysis in plain and simple language. Among others, the lessons cover the basic things you need to know when is the appropriate time to buy a stock. A few hours spent learning the basics will save you from so much trouble later on.

Youtube Channel https://www.youtube.com/theresponsibletrader (Subscription is free. After subscribing and for those who have subscribed already, please send an email to: The Responsible Trader ninjatrader919@gmail.com. Subscribers will be given first priority when we release the book, “The Responsible Trader” and will get it at a special price, less than price you will pay in a regular bookstore.)

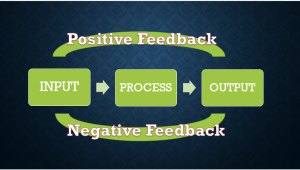

- Think in terms of systems. Trading is best understood in a wholistic manner. It is not just stock picking and waiting for the price to go up. The systems approach is illustrated in the diagram below:

All the information you receive are inputs to the system and you process them by doing either fundamental analysis, technical analysis or both. The output is your trading plan and the results you obtain whether positive or negative serve as your feedback mechanism for making adjustments.

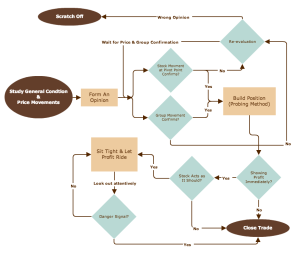

Since you now have a basic idea of the systems approach, for the Jesse Livermore fans I would like to share this flowchart (not mine, just got it from the internet) which might be able to help you in improving your trading skills.

Source: http://www.livermoresecret.com/jesse-livermore-trading-system/overview-jesse-livermore-trading-system/

- Learn to walk before you run. Most of the people who approached us for help when asked about their trading time frame did not even have any idea about the concept. As a result of the hype, they have either engaged in scalping trades or daytrading without even knowing it. Below is a matrix where we made a comparison of the physical as well as the mental demands required for each activity. With walking as a baseline, trading styles are compared for better understanding.

In Responsible Trading we categorize our Trading as Situational Trading and we have divided these into trading styles to guide us in our objectives and expectations. This also allows us to take advantage of opportunities as we see them unfold in the market.

We suggest gradual learning to get a feel of the market. Investment is the best way to learn because you can do everything at your own pace and your own time. For those not keen on investing, we suggest position trading or swing trading.

Being a victim could be case of ignorance or of circumstance. Remaining a victim, however, is a choice – a matter of decision. In trading as in life you only get two things: excuses or results and they are inversely proportional to each other. The more the excuses, the less the results. The less the excuses, the more the results.

We have given several suggestions so that Victims can rise from their failures and become Victors. This is an invitation to move from the darkness of MISGUIDED TRADING to the light of RESPONSIBLE TRADING. The choice and final decision is yours. I believe you have already made the right one.

Good luck on your learning journey and we wish you the best in all your trades.